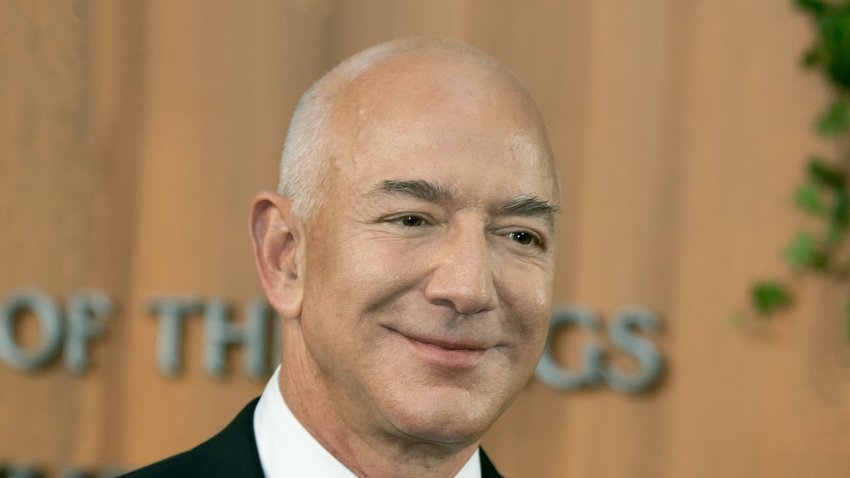

Jeff Bezos' morning routine includes scrolling and dragging his feet: ‘I'm not as productive as you might think'

Jeff Bezos doesn’t jump to tackle work and responsibilities in the morning. Here’s why the billionaire entrepreneur embraces a slow start to the day.

-

Summer airfares expected to be higher this year due to decreased supply of Boeing planes

Prices for airfare for your summer vacation may be sky high this year after manufacturing delays for new Boeing aircraft are likely to decrease the amount of flights available in the United States.... -

Lululemon to shutter Washington distribution center, lay off 128 employees after tripling warehouse footprint

Lululemon is shutting down its Washington distribution center and laying off 128 employees after it opened a massive new warehouse outside of Los Angeles.

-

Hyundai pauses X ads over pro-Nazi content on the platform

Automaker Hyundai said it had paused its advertising on Elon Musk’s social media app, X, after a sponsored post from the company appeared next to antisemitic and pro-Nazi posts. Hyundai confirmed the ... -

Google fires 28 workers in aftermath of protests over big tech deal with Israeli government

Google has fired 28 employees in the aftermath of protests over technology that the internet company is supplying the Israeli government amid the Gaza war, further escalating tensions surrounding a ho...