-

Americans have $1.13 trillion in credit card debt. Here are some expert tips to help pay yours off

Cardholders are carrying more credit card debt than ever before and paying record high interest rates. Here are the best ways to jump-start debt repayment.

-

What should I pay off first if I have student loans and other debt?

The average American has more than $92,000 in debt, which includes credit cards, student loans, mortgages and more.

-

‘Debt relief' company puts woman in thousands of dollars of additional debt

Already in debt and seeking relief from a Chicago-based “debt relief” company, one woman was plunged further into debt, NBC Chicago’s PJ Randhawa reports.

-

‘Debt relief' company puts woman in thousands of dollars of additional debt

It’s an industry that often paints itself as a life-preserver for those drowning in debt.

-

What to know about the student loan repayments?

Starting Sept. 1, student loans will continue accruing interest, and monthly bills will start up again in October.

-

54 million Americans have been in credit card debt for at least a year. Here are the best payoff strategies

More cardholders are carrying more credit card debt than ever before, and, on top of that, they’re paying record high interest rates.

-

House Passes Bipartisan Bill to Raise Debt Ceiling and Avert Default

The hard-fought deal pleased few, but lawmakers assessed it was better than the alternative — a devastating economic upheaval if Congress failed to act.

-

Debt Ceiling Talks Make Progress, But House Will Leave Town With No Deal

Congress faces a June 1 deadline to raise or suspend the debt ceiling in order to avoid a catastrophic default.

-

McCarthy Says House Could Vote on Debt Ceiling Deal as Soon as Next Week

“I just believe where we were a week ago and where we are today is a much better place,” said McCarthy, sounding more optimistic than ever about a deal.

-

Biden Administration Has Canceled $66 Billion in Student Debt. How to Know If You Qualify

Under President Joe Biden, the U.S. Department of Education has in recent years canceled more than $66 billion in education debt.

-

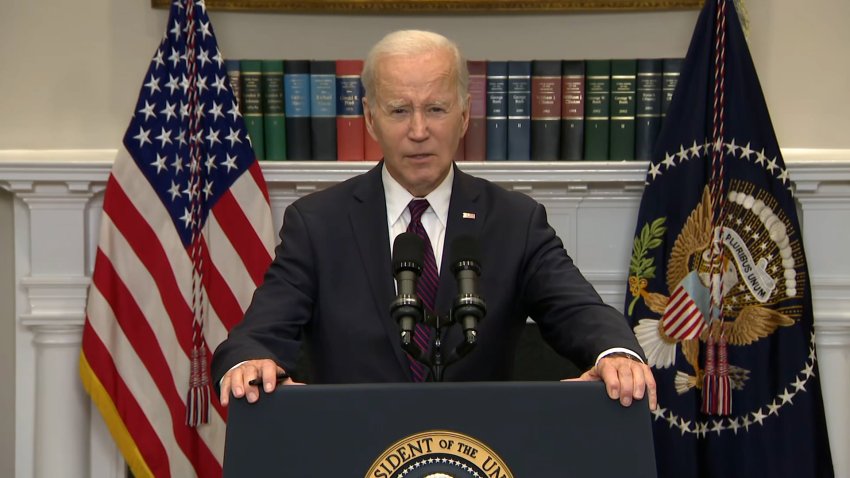

Biden: ‘The United States Is Not Going to Default'

President Biden met with congressional leaders Tuesday to discuss the nation’s debt ceiling in the face of a potential default and economic catastrophe.