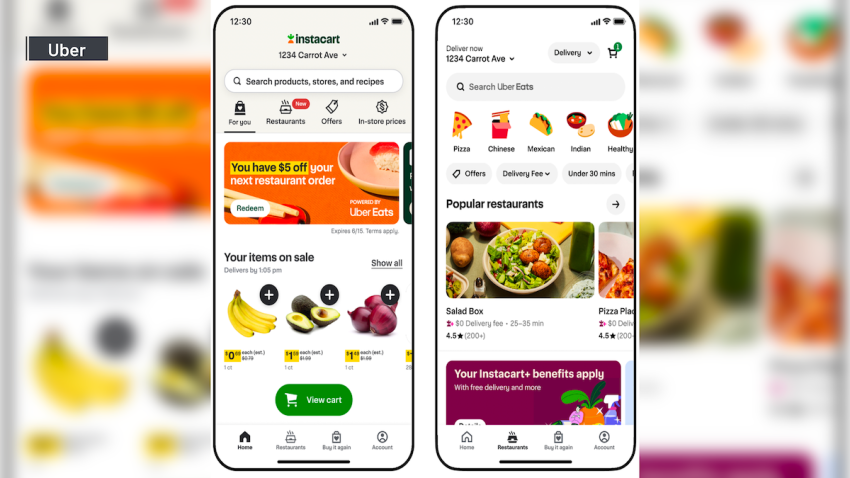

Instacart partners with Uber Eats to offer restaurant deliveries

San Francisco-based Instacart said Tuesday that its U.S. shoppers will see a “Restaurants” tab in the company’s app in the coming weeks.

-

Federal trade commission sues to block $8.5 billion merger of Coach and Michael Kors

The Federal Trade Commission sued to block Tapestry, Inc.’s $8.5 billion acquisition of Capri Holdings Ltd., saying that the deal would eliminate direct head-to-head competition between the fashion co... -

Express files for Chapter 11 bankruptcy protection, plans to close nearly 100 stores

The company said it planned to close 95 of its Express retail stores and all UpWest stores.

-

Couple grew their basement side hustle into a business bringing in $4.5M per year: We'd ‘never seen anything like that in a bank account'

Audrey Finocchiaro and Sam Lancaster nearly gave up on The Nitro Bar. Now, their coffee business brings in $4.5 million a year across Rhode Island and Massachusetts.

-

Summer airfares expected to be higher this year due to decreased supply of Boeing planes

Prices for airfare for your summer vacation may be sky high this year after manufacturing delays for new Boeing aircraft are likely to decrease the amount of flights available in the United States....