- The so-called "marriage penalty" kicks in when tax-bracket thresholds, deductions and credits are not double the amount allowed for single filers.

- If you were married at any point last year, you're required to file your 2020 tax return as a married couple.

- The deadline this year for filing your federal tax return is May 17.

Some newlyweds get an unwelcome gift from the IRS: a bigger tax bill.

While many couples end up paying less in taxes after tying the knot, some face a "marriage penalty" — that is, they end up paying more in taxes than if they had remained unmarried and filed as single taxpayers.

The penalty occurs when tax-bracket thresholds, deductions and credits are not double the amount allowed for single filers — and it can impact both high and low earners, as well as younger or older taxpayers.

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter here.

More from Personal Finance:

1 in 10 people fall victim to gift card scams

Here's how much you need to earn to afford a house

Buying Tesla with bitcoin could mean a tax bill

For marriages that occurred at any point last year, you're required to file your 2020 tax return as a married couple, either jointly or separately. (However, filing separate returns as a married couple usually provides no financial benefit.) If you plan to marry this year, you've got a year to prepare for filing your 2021 return.

The deadline this year for filing your 2020 federal tax was delayed to May 17 (state returns may have different deadlines). So far, the IRS has issued 56.5 million refunds averaging $2,902 each, according to data through March 26.

Money Report

Here's what to know about the marriage tax penalty.

For higher-income couples

A bigger tax bill can come from a few different sources for higher earners.

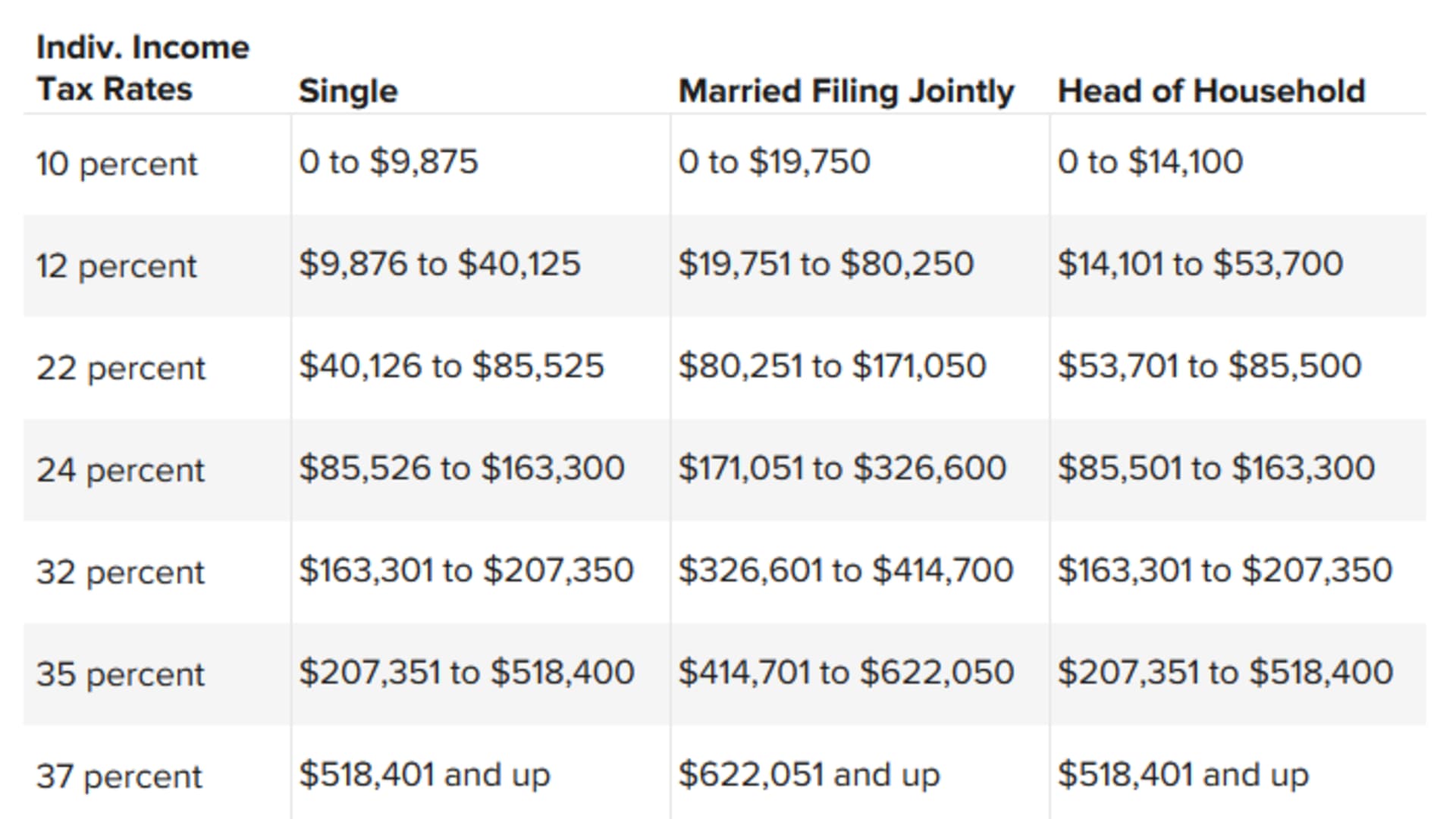

For 2020 returns, the top federal rate of 37% kicks in at taxable income of $518,400 for single filers. Yet for married couples filing jointly, that rate gets applied to income of $622,050 and higher.

"The tax brackets are doubled for most taxpayers, but there's still a penalty for the top tax rate," said Garrett Watson, a senior policy analyst at the Tax Foundation.

For illustration: Two individuals who each have income of $500,000 would fall into the tax bracket with the second-highest rate, 35%, if they filed as single taxpayers.

However, as a married couple with combined income of $1 million, they would pay 37% on $377,950 of that (the difference between their income and the $622,050 threshold for the highest rate). That would mean paying about $7,760 more in income taxes for 2020.

There are also other provisions of the tax code that can affect higher earners more when they marry. For instance, while an individual can have up to $200,000 in wage income before the Medicare surtax of 0.9% kicks in, the limit for married couples is $250,000.

Likewise, the income threshold for the 3.8% investment-income tax is not doubled. Singles with modified adjusted gross income above $200,000 pay the tax, while married couples filing jointly pay it if their income exceeds $250,000. (The tax applies to things such as interest, dividends, capital gains and rental or royalty income.)

Additionally, the limit on the deduction for state and local taxes — also known as SALT — is not doubled for married couples. The $10,000 cap applies to both single filers and married filers. (Married couples filing separately get $5,000 each for the deduction). However, the deduction is available only to taxpayers who itemize.

For lower earners

For people with lower income, a marriage penalty can arise from the earned income tax credit.

The credit is available to working taxpayers with children, as long as they meet income limits and other requirements. Some low earners with no children also are eligible for it.

Because it's refundable — meaning it could result in a refund even if your tax bill is zero — it's considered valuable to working parents with low or modest income.

However, the income limits that come with the tax break are not doubled for married couples (see chart below for 2020 parameters). And while recent legislation expanded the credit for 2021 — largely for working people without children — the income limits are still not doubled from single filers to married couples filing jointly.

State taxes

Fifteen states also have a marriage penalty for taxpayers built into their marginal tax brackets, although it's more pointed in some places than others. For example, for 2020, Maryland's top rate of 5.75% applies to income above $250,000 for single filers and above $300,000 for married couples.

Some states allow married couples to file separately on the same return to avoid getting hit with a penalty and the loss of credits or exemptions, according to the Tax Foundation.

Social Security income

If you're retired and already receiving Social Security, be aware that getting married can have additional tax implications.

For single filers, if the total of your adjusted gross income, nontaxable interest and half of your Social Security benefits is under $25,000, you won't owe taxes on those benefits. However, for married couples filing a joint return, the threshold is $32,000 instead of double the amount for individuals.

Additionally, if you or your new spouse contribute to traditional or Roth individual retirement accounts, pay attention to how much you put in those IRAs. There are limits that apply to deductions and contributions, and income from both spouses feeds the equation.

The Tax Policy Center has a marriage calculator that lets you plug in details of your and your partner's financial life — wage income, business income, children you claim as dependents, etc. — to see how your taxes would shape up when you file as a married couple.