- Social Security may no longer be able to pay full benefits by the 2030s if no changes are made sooner.

- While lawmakers contemplate possible fixes, a new web tool from the American Academy of Actuaries lets you decide exactly what changes should be made.

You may have heard that Social Security's funds are running low.

If that doesn't change, it may interfere with the program's ability to pay full benefits in the next decade.

Now, a new virtual tool from the American Academy of Actuaries lets you explore Social Security's woes and decide exactly what changes you would make to restore its solvency.

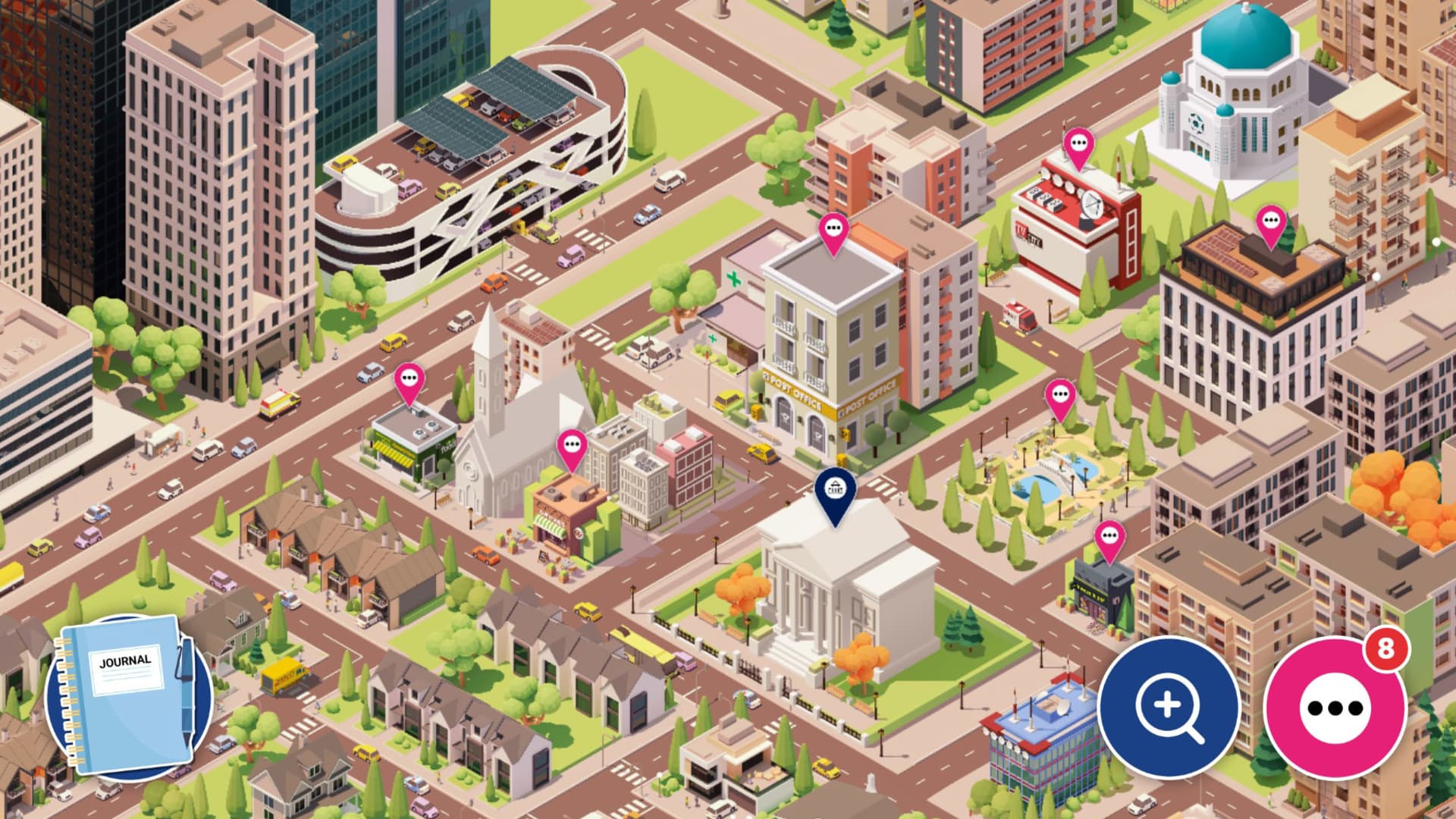

The journey starts in Townsville, a virtual city that aims to show the perspective of everyday Americans, according to the web app created by the nonpartisan professional organization.

At the outset, users learn the dilemma Social Security currently faces. Based on the Social Security Administration Board of Trustees' annual 2022 report, the funds may be depleted in 2035. At that point, 80% of benefits would still be payable.

Money Report

"A common misconception is that the trust fund exhaustion would mean Social Security benefits could not be paid at all," said Linda K. Stone, a senior pension fellow at the American Academy of Actuaries.

The urgency of Social Security's issues has caught lawmakers' attention recently.

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter here.

During the State of the Union address in February, President Joe Biden prompted leaders from both sides of the aisle to stand to show their support for protecting Social Security and Medicare.

But solving the program's woes won't necessarily be clear cut.

Generally, it will require either raising taxes, cutting benefits or a combination of both.

Multiple proposals have been put forward in Congress. However, the difficulty is getting both sides of the aisle to agree. For any Social Security reforms to pass, they must have bipartisan support.

"When you're dealing with Social Security, it's really important for everybody involved from a political standpoint to be willing to hold hands and jump together," said Shai Akabas, director of economic policy at the Bipartisan Policy Center.

'More needs to happen' to fix Social Security

By using the American Academy of Actuaries' web app, called "The Social Security Challenge," players may visit different locations in Townsville to hear locals' opinions and concerns about the future of the program.

At locations including the park, the gym and the post office, residents discuss their concerns or opinions about possible changes, such as increasing the amount of payroll taxes the wealthy pay or increasing benefits for the lowest earners.

Players can also access a journal with notes that provides key information on the topics they've heard.

Once they have explored all the locations in Townsville, users then go to Town Hall, where they can decide exactly what changes they would make to improve the program.

Users are presented with nine buckets of options. They may choose from all, some or none of the buckets when choosing from the menu of reforms.

Notably, this may include improvements to benefits that add costs, as well as other changes that would result in savings.

This may include changes to help bring in more revenue into the program, such as applying payroll taxes to earnings over $250,000. In 2023, those levies are capped at $160,200 in earnings.

Or it may include benefit increases such as changing annual cost-of-living adjustments to be more generous or making it so years out of the workforce devoted to child care are included toward Social Security benefit calculations.

"The important point is that users learn about the wide variety of options available to address the insolvency issues and the different impacts of adopting some of these options," Stone said.

As policymakers' debate over Social Security's future heats up, the tool may help increase the public's understanding of the discussions, Stone said.

More from Personal Finance:

Prioritizing retirement, emergency savings in shaky economy

Whether bank crisis causes recession may depend on 'wealth effect'

The IRS plans to tax some NFTs as collectibles

The tool may also help them see that implementing just one change — such as increasing payroll taxes — might not be a silver bullet solution to restore the program's solvency.

"People select options that they think, 'Oh, this will solve the problem,' and then they can clearly see, no, that's not enough," Stone said. "More needs to happen."

The American Academy of Actuaries is encouraging policymakers to share the web app with constituents to educate them about Social Security and get their feedback on what changes they would like to see.

To decide how you might fix the program, check out the tool here.