Weeks after the U.S. Supreme Court dealt a harsh blow for student loan borrowers hoping to take advantage of President Joe Biden’s forgiveness plan, his administration has clapped back with two paths forward toward wiping away student debt.

The clock is ticking as student loan payments are expected to resume this fall after a three-year pause brought on by the pandemic.

But if a borrower is eligible for an income-driven repayment plan, there could be some relief.

At 30 years old, Jonathan McGee, of Englewood, works full-time with three college degrees under his belt, including two masters.

McGee says he has been watching the news surrounding student loan debt forgiveness closely.

“When you think about the graduation rates, folks that came in from neighborhoods like I came, many didn’t make it past their first year,” McGee said. “It wasn’t because of a lack of performance, but a lack of funding.”

That lack of funding meant McGee had to take out loans to pay off his higher education. And though he’s successful by anyone’s standards, McGee continues to live under a mountain of debt.

“I think a mountain is a nice way of putting it,” McGee said. “It’s depressing.”

McGee’s debt is close to $150,000, and he’s not alone.

The average debt per borrower in Illinois is more than $46,000 each, according to a study by the online lender Lending Tree.

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter here.

McGee said he was hoping to benefit from Biden’s student loan forgiveness plan, but last month, he and other borrowers’ hopes were struck down by the Supreme Court.

Now, for certain borrowers, the president is trying two other paths forward, each having to do with income-driven repayment plans.

Biden announced last Friday that the Department of Education would automatically erase $39 billion in debt, likely for more than 800,000 borrowers on income repayment plans, which have accumulated the equivalent of 20 or 25 years of payments.

The Department of Education revised borrowers accounts to retroactively count months of payments that were previously not counted or didn’t qualify.

Officials said borrowers impacted by this change should find out by mail in the coming days.

If a borrower is not eligible for that, depending on their annual income, there may be another way for relief.

Another effort is branded the “Saving on A Valuable Education” or “SAVE” repayment plan, and it calculates your monthly payment amount based on your income and family size.

Jill Desjean, a Senior Policy Analyst with the National Association of Student Financial Aid Administrators (NASFAA), says the SAVE plan is not a new plan, rather a rebrand of an already existing repayment plan with much more favorable terms for borrowers.

“It’s much more generous now than all of the existing income driven repayment plans for borrowers,” Desjean said.

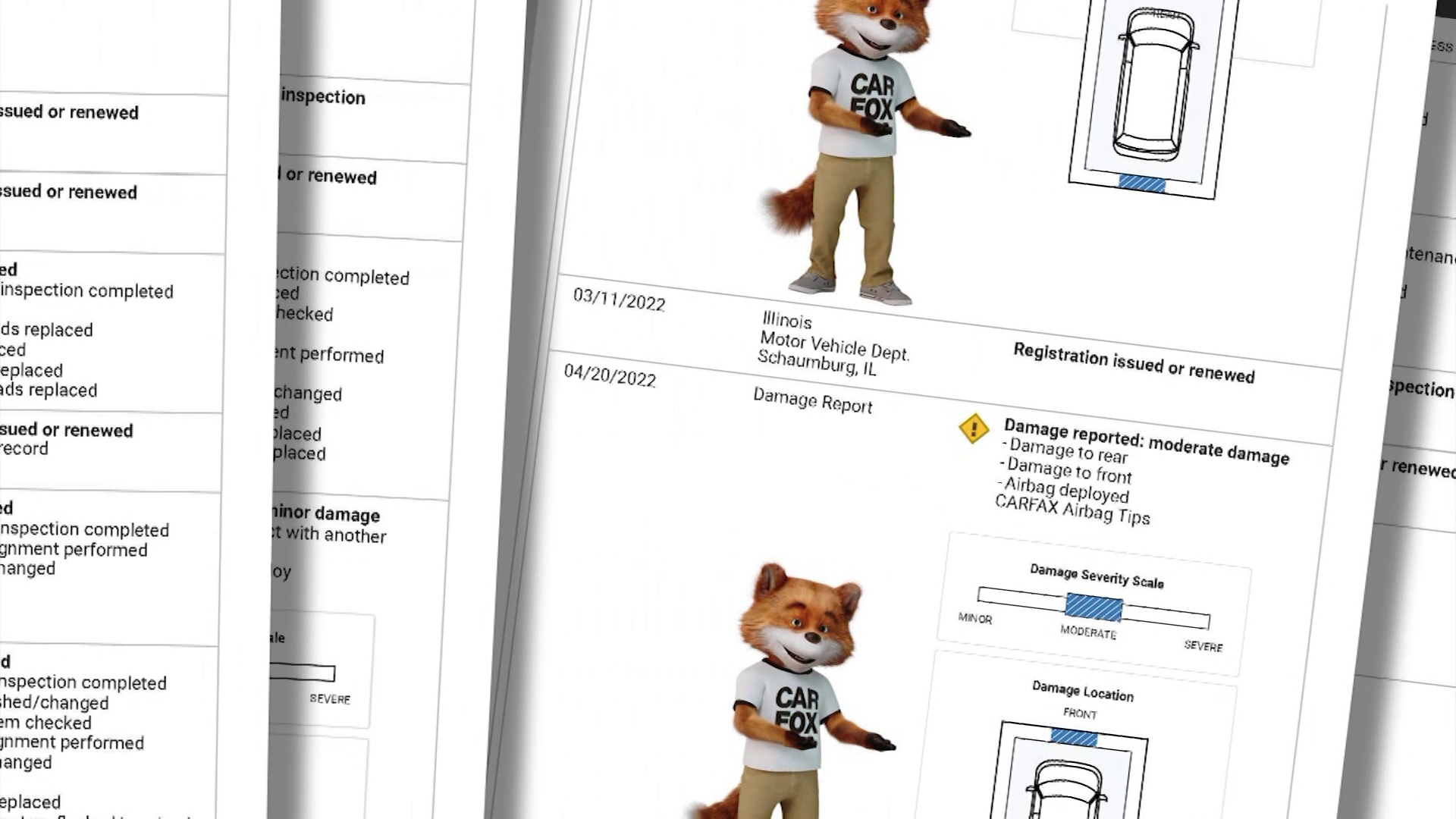

The Department of Education released the graphic below showing examples of student loan monthly payments, under the SAVE plan.

Borrowers who applied for the president’s original student loan forgiveness plan will automatically be enrolled in the SAVE plan. And for borrowers who haven’t applied, the Department of Education says it will notify borrowers when the new application process launches this summer.

However, with these announcements, borrowers are fearful these plans will also be struck down in court.

Desjean said it’s hard to say if the administration has firm legal footing.

“They've argued that the new SAVE plan is no different from their authority to create repayment plans,” Desjean said. “It's just more generous.”

Critics see it much differently.

Senate Republicans have argued these changes are “turning the federal student loan financing system into a poorly targeted taxpayer funded grant program.”

And the New Civil Liberties Alliance told NBC 5 in part that this “flies in the face of the Supreme Court’s recent decision that only Congress can enact a loan-cancellation program.”

These plans will not help everyone, including McGee. Due to his income size, he said he doesn’t qualify for these forgiveness plans.

He believes the only way real relief will come is if Congress acts.

“With inflation, the economy, all the issues we’re facing economically, it’s just unmanageable," McGee said.