This story is part of CNBC Make It's Millennial Money series, which profiles people around the world and details how they earn, spend and save their money.

In 2017, Kevin Paffrath's dream was to earn over $1 million a year from The Paffrath Organization, the real estate business he owns with his wife, Lauren, in Ventura, California.

In 2020, the couple earned $1.075 million in May alone. "It was absolutely surreal," says Lauren, 30, of the moment they crossed into the seven-figure-a-month territory.

Don't miss: Highest-ever Amex Gold Card welcome bonus is worth up to $600 in gift cards

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter here.

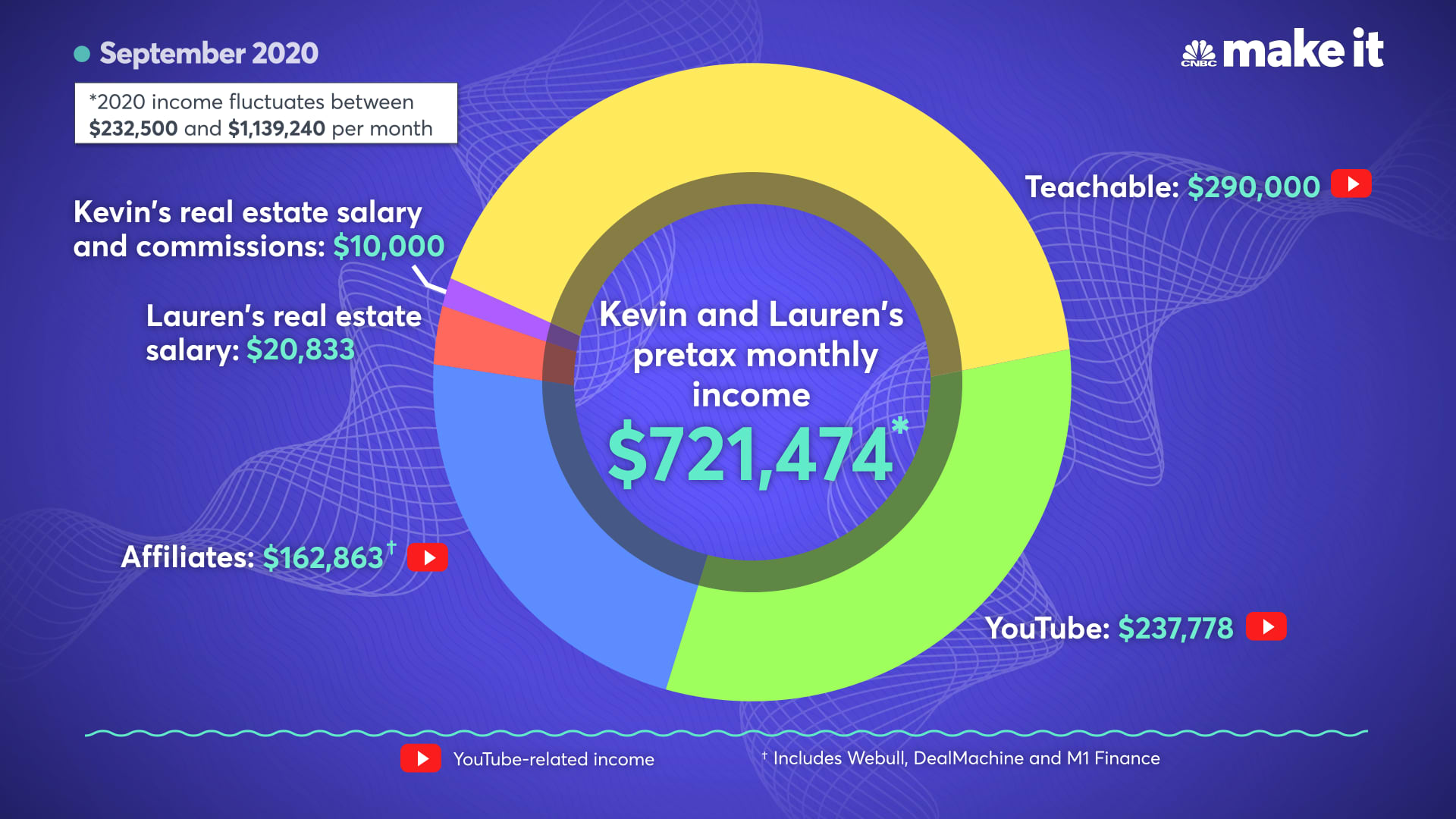

But the bulk of their income isn't coming from real estate transactions or rental income. The couple makes money through Kevin's YouTube channel, Meet Kevin, which he started posting to regularly in 2018, as well as numerous affiliate programs. While they don't bring in seven figures every month — they earned $721,474 in September 2020 — they're on track to earn more than $6 million total this year.

While some of their success can be attributed to good luck, they've also put in countless hours to get where they are today. As his YouTube channel became increasingly lucrative, Kevin, 28, began dedicating more and more time to creating content, including getting up before the sun to make several videos a day.

Lauren is the property manager for the couple's real estate business and has also taken on full-time child-care duties for their two young sons, Jack, 5, and Max, 2. Neither of their children is attending school in-person right now due to the Covid-19 pandemic.

The hardest part of their success has been balancing work and family. "I just had our second son right when Kevin started making YouTube videos and getting monetized, so it was definitely an adjustment," Lauren says. "Kevin's nature is very much 'take on as much as you possibly can take on and work, work, work, work.'"

Money Report

Kevin typically works 12 hours a day, from 5 a.m. to 5 p.m. but reserves his evenings for family time. "The goal is to have a drop-dead deadline of 5 p.m. to just hang out with the kids," he says.

Finding a niche in real estate

While Paffraths are millionaires today, Kevin didn't grow up in a wealthy family. His parents moved to the U.S. from Germany when he was 18 months old and divorced when he was six. Kevin remembers finances always being tight: As a kid, he once asked his dad for a $20 bill in the bank drive-through. His dad declined. "I only have 11 of these left," he said.

In high school, Kevin participated in a law enforcement explorer program, in which he learned about becoming an officer and spent over 3,000 hours riding along with the local police. He liked the program and assumed he'd end up with a career in law enforcement. But then one of the officers he worked with told him about his side gig as a realtor, which piqued Kevin's interest.

Lauren, on the other hand, grew up in the world of real estate, watching her parents sell homes and manage properties. Like her mother, she started managing properties professionally at 18.

The couple met in high school while on a trip to Paris, but lived on opposite sides of the country. During the summer before his senior year, Kevin moved from Florida to California to live with Lauren's family while he finished high school. As Kevin spent more time around Lauren's father, his interest in real estate deepened. He started studying to become a realtor and earned his license during his freshman year of college.

But as Kevin attempted to launch his real estate career as a college student, he didn't think anyone would want to buy a house from a 19-year-old with no experience. The solution: He and Lauren would buy a house, fix it up and prove their skills.

"We ended up finding a trashed fixer-upper in foreclosure," Kevin says of the first house they bought in 2012 for $305,000. "We had barely $8,000 each to our name to fix this place up. There was no kitchen, the bathrooms were gone, the toilets were gone. It was a disaster."

More than a dozen trips to IKEA later, the house was livable. And as the Paffraths showed their home to potential clients as proof of what they could do, they realized the path they wanted to take within real estate: buy rundown homes, renovate them and rent them out.

"We got kind of addicted to the idea of owning homes and renovating them, and especially in a cost effective way," Lauren says.

Over the next few years, they continued to buy, renovate and rent out properties while Kevin finished up his degree at UCLA in 2014. Today, they own 22 properties in Southern California: 20 rentals, one in escrow and the home they live in. Nine are currently being renovated.

As the property manager for The Paffrath Organization, Lauren makes all of the design decisions and coordinates the renovations with contractors. She takes a salary of $245,000 from the business, while Kevin takes $100,000 plus commissions on homes he buys.

They work well together: "Lauren picks the colors and tells me where to put the stuff," Kevin jokes.

"He doesn't ask any questions. He just goes, 'OK, Lauren. You got it,'" she laughs.

Getting started on YouTube

When Kevin first launched his YouTube channel, he mostly shared videos about "all the things I screwed up on to try to help prevent people from making the same stupid mistakes that I had made," he says.

But as he gained traction, he expanded his content to include investing advice and market news. He also increased the number of videos he made from one per week to several per day and monetized the channel on the advice of Graham Stephan.

The new content was a hit with his audience. And as his following grew, so did his income. Kevin currently has 947,000 followers on YouTube and earns an average of $150,000 per month from the platform itself.

He's also been able to leverage his channel and following to generate other income streams. The most lucrative one is selling online courses on Teachable, a platform where entrepreneurs can get paid to share their expertise. He earns an average of $332,000 a month, but it can be higher or lower. In September, he made about $290,000. Kevin makes money from affiliate links and partnerships as well and expects to bring in $80,000 or more a month from them.

Lessons learned

Not all of the couple's business ventures have been successful, however. In 2017, they decided to add a construction arm to The Paffrath Organization. The idea was to turn the business into a one-stop shop for clients by offering renovation, design and lending services.

But hiring employees, purchasing materials and working on thin cost margins meant there wasn't much room for error. Even small mistakes hurt the bottom line, and they ended up losing $1 million on the endeavor in less than 18 months.

For Kevin, it was a lesson in avoiding businesses with high upfront costs. He'd rather stick to things like real estate, which only requires his time, not materials, he says.

And while Kevin's YouTube channel is a big money maker for the family, it also landed him in some legal trouble as well. In one case, he made a series of videos about real estate mogul Grant Cardone criticizing his methods and "making fun of the guy," as Kevin puts it. He also showed up at Cardone's office in Florida and had flowers delivered in order to "make a point," he says.

Kevin was charged with trespassing and disorderly conduct, and the charges were dismissed. Overall, Kevin has spent around $100,000 in legal fees, including matters that did not involve Cardone. But Kevin chalks up the whole thing to a learning experience, and the couple decided to take on more insurance to cover future mishaps.

Cardone did not respond to a request for comment.

How they spend their money

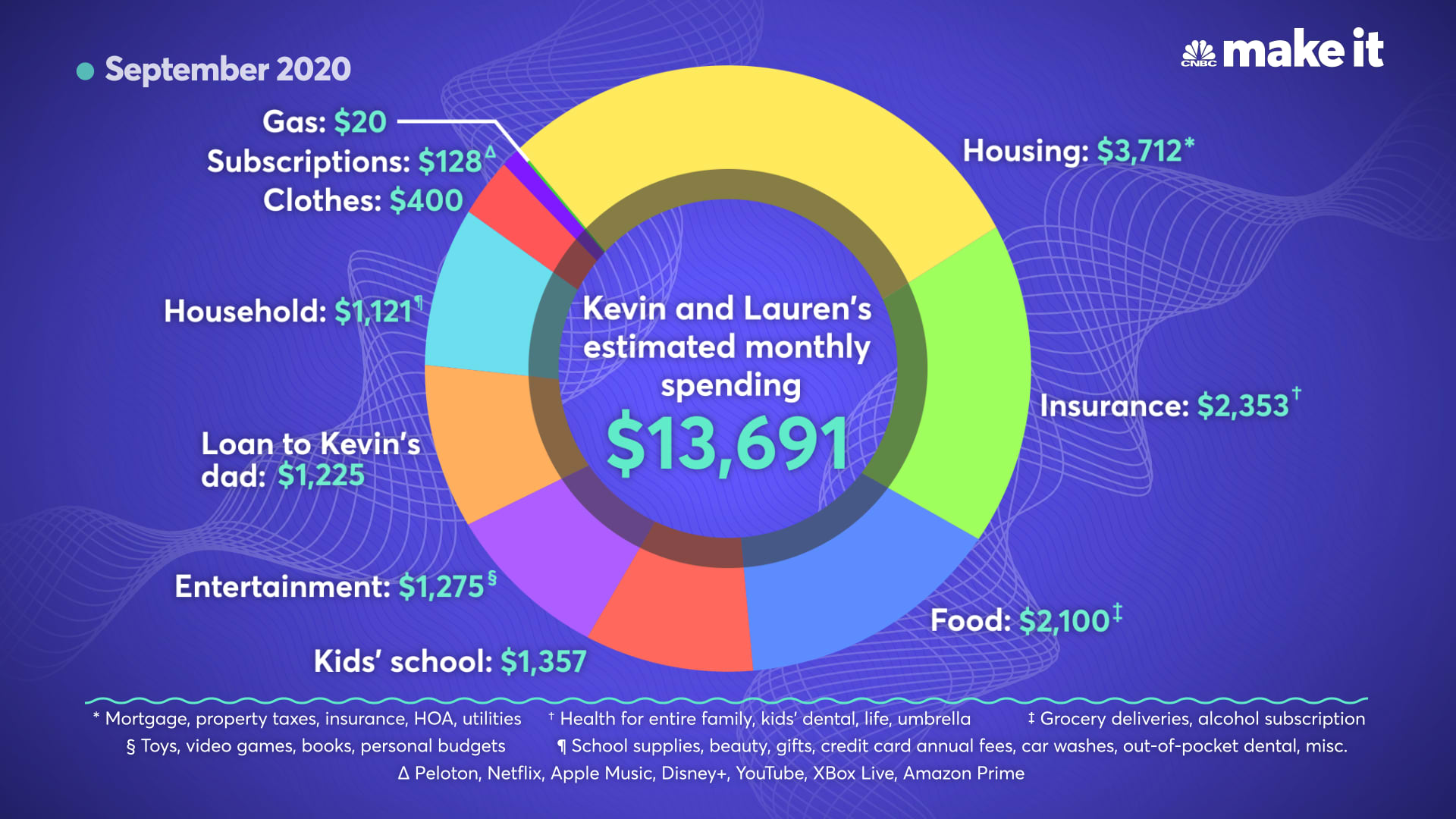

Kevin and Lauren's monthly expenses usually adds up to just a fraction of their income. Here's a look at their spending in September 2020.

- Housing: $2,956 (includes principal, interest, property taxes, homeowners insurance and HOA fees)

- Insurance: $2,353 (includes health insurance for the entire family, dental insurance for the kids, life insurance for both Kevin and Lauren, and an umbrella policy; Kevin pays for dental work out of pocket)

- Food: $2,100 (The couple spends around $1,750 on grocery delivery, plus $350 on alcohol and a wine subscription service. They haven't been going out to eat during the pandemic.)

- Kids' school tuition: $1,357 (Jack attends school virtually because of the pandemic, but Max is not attending right now.)

- Entertainment: $1,275 (includes kids' toys, video games, books, new activities for Kevin and Lauren and $250 each to use as a "personal budget" on whatever they wish)

- Loan to Kevin's dad: $1,225

- Household expenses: $1,121 (includes school supplies, home maintenance and organization, Lauren's beauty products, a car wash service, gifts, credit card annual fees and Kevin's dental expenses)

- Utilities: $756 (includes cable, Wi-Fi, water, electricity, gas and trash)

- Clothes: $400

- Subscriptions: $128 (includes Peloton, Netflix, Apple Music, Disney+, YouTube Premium, paid YouTube memberships, Xbox Live and Amazon Prime)

- Gas for Lauren's car: $20

Since the pandemic started, Lauren primarily stays home with the kids and doesn't use her car much. Kevin's Tesla is covered by the business, along with their car insurance and both of their phones.

The pandemic has also changed their spending habits. Before March, they budgeted $300 a night for date nights a few times a week and hired additional child care for about 20 hours per week. They also used to travel regularly, spending an average of $1,000 a month.

An unusual monthly expense is the loan they pay to Kevin's dad. When his father retired, Kevin worried that he would blow through all of his money in a short period of time. He wanted ensure that he had a steady stream of income in retirement, so he offered to manage his father's money for him. To do this, Kevin borrowed a lump sum and is paying it back, with interest, on a monthly basis.

They admit that having kids also made a significant impact on their budget. "We definitely spend more money on them than we do ourselves," Lauren says. It's easy for her to pass on new clothes or accessories for herself, but if one of her kids wants something, it's much harder to say no, she says, especially if it's educational.

Planning for the future

There's one thing Kevin almost never does with his money: put it in a savings account. He'd rather see his money grow.

After covering their monthly expenses, the couple reinvests the majority of what's left back into their business, usually to buy more real estate and renovate the properties they own.

They do put money away for retirement. At the end of the tax year, both Kevin and Lauren put a lump sum of $14,100 in their respective SIMPLE IRAs.

Kevin also manages the couple's substantial investment portfolio. They have around $7.4 million in investments, split across several brokerage accounts.

Going forward, the Paffraths want to keep building their real estate business and growing their investments, but they don't have a target net worth in mind. They'd rather focus on their time as a family.

Once the pandemic is over, "we're really excited about growing our family, traveling with our children, letting them experience life in other countries and just trying to live life to its fullest," Lauren says.

For Kevin, that still includes his 12-hour workdays.

What's your budget breakdown? Share your story with us for a chance to be featured in a future installment.

Check out: This 23-year-old Uber driver earns $25,000 a year—but has ‘everything I could want right now’

Here are the 5 best loans for refinancing credit card debt