This story is part of CNBC Make It's Millennial Money series, which details how people around the world earn, spend and save their money.

Alexandra Capellini has known she wanted to be a doctor since she was 7.

That's when the Brooklyn native was diagnosed with an aggressive bone cancer in her right knee. Her treatment consisted of not only chemotherapy, but also amputation of the leg above the knee.

Spending so much time with nurses, doctors and therapists as she recovered made it easier for her to get through "a really hard time" in life, she says. It convinced her that there was only one thing she wanted to do when she grew up.

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter here.

"I've known that I've wanted to do this for a very long time," Capellini, now 26 and in her fourth year at the Icahn School of Medicine in New York City, tells CNBC Make It. "By the time I finished chemotherapy and I was ready to leave the hospital and start going back to school again, I remember telling my oncologist, 'I'd like to be back here someday.'"

Her goal is to eventually become a pediatric oncologist and treat children and teens with cancer. It's a decision that came to Capellini easily, but not cheaply.

She is currently on a research year between her third and fourth years of medical school and earns a $28,000 annual stipend, which she receives in $945 installments after taxes every two weeks. The stipend is barely enough to cover her frugal lifestyle living on New York City's Upper East Side, let alone make a dent in the student debt burden — including $130,000 from undergrad — that she expects will surpass $400,000 by the time she graduates.

Money Report

After medical school, Capellini will enter a residency program, where she expects to earn $55,000 to $65,000 for the next four or five years. Ultimately, she hopes to earn a salary four times that size.

"That [salary] would leave me in a good place to at least make a dent with these loans," she says. "But it's still going to take decades."

How she spends her money

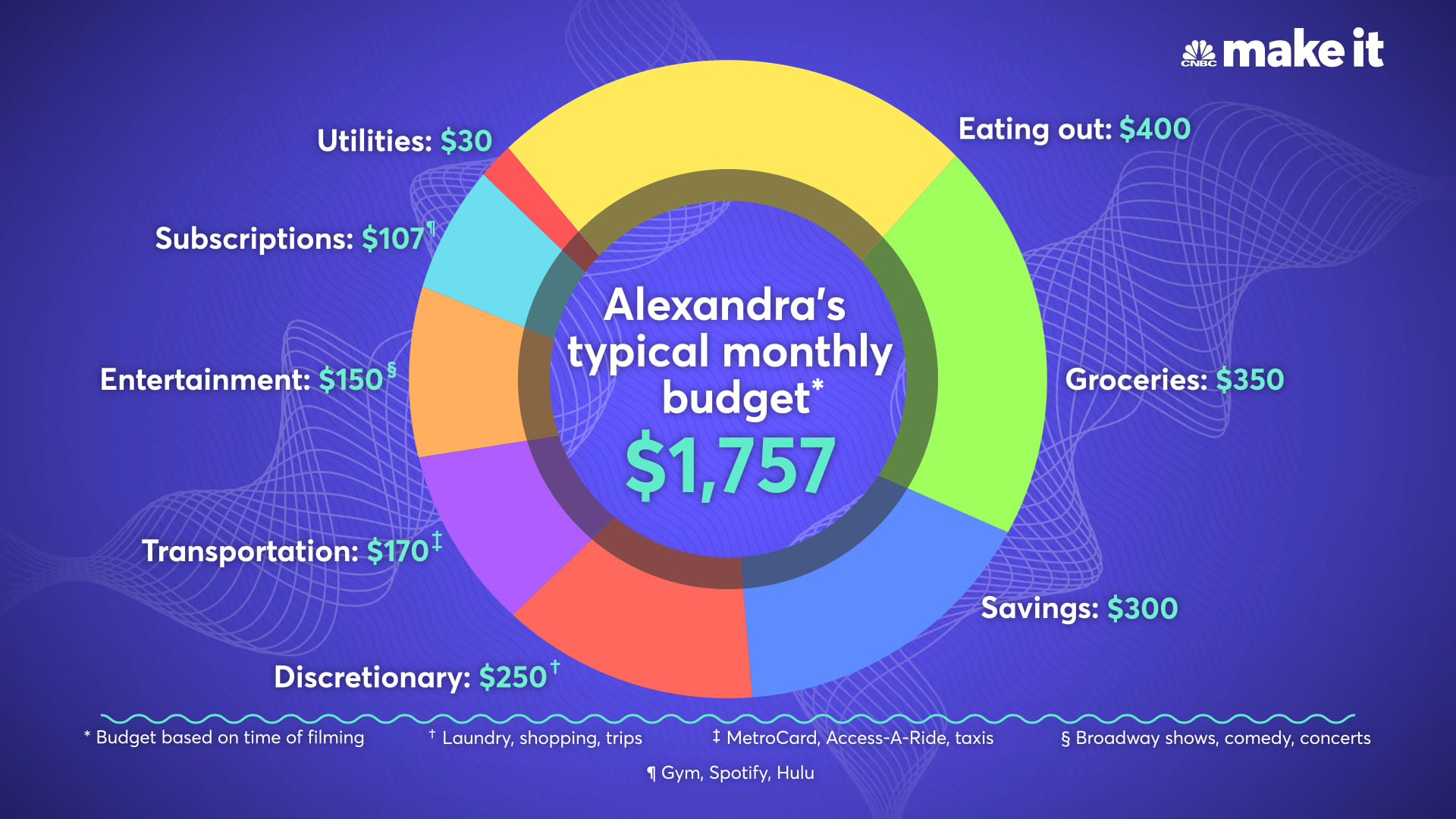

Here's how Capellini budgeted her money in February 2022.

- Dining out: $400

- Groceries: $350

- Savings: $300

- Discretionary: $250 on shopping, laundry and trips

- Transportation: $170 for her MetroCard, taxis and Access-A-Ride

- Entertainment: $150 on concerts, comedy and Broadway shows

- Subscriptions: $107 for Spotify, Hulu and her gym memberships

- Utilities: $30

Capellini lives in subsidized student housing. The rent for her room in a three-bedroom apartment is $650 a month. Her parents cover her rent, as well as her $450 monthly insurance payments. Without their help, Capellini would need to take out even more loans to get through school.

"It's a really tight squeeze to make the stipend stretch to cover housing and living expenses," she says. "I've been lucky to have my parents help me with rent this year."

Capellini says it is common to see students relying on family to help ease the financial burdens of medical school.

"One of the biggest takeaways from being here and getting to know all of my classmates and what we're dealing with financially is most of us are reliant on some sort of family support to make ends meet," Capellini says. "We're all 26, 27 years old. None of us have $80,000 a year for medical school."

Her busy schedule — which involves working full-time with the research team during the day and taking masters classes at night three times a week — leaves very little time to earn money on the side. Occasionally, she earns money by walking dogs or babysitting, but it is difficult to find consistent income.

Even with her large debt burden, Capellini doesn't have a credit card. The prospect of paying off her debt for decades has left her wary of putting herself any deeper in the hole.

"I'm not counting pennies, but I'm very hesitant to even think about adding credit card debt," she says. "I'm not even in a place to tackle what I already have."

Student life in New York City

Being on a tight budget doesn't mean that Capellini can't enjoy herself. The 26-year-old still makes a point to take advantage of New York City's cultural offerings. She goes to comedy shows and concerts — taking advantage of student discounts when possible — and budgets $100 so that she can go out for drinks and meals with her friends on the weekends.

"Weekdays are so busy with lab and handling class and all of the commitments of being a medical student that by the time the weekend comes, I really try to prioritize making time to meet up with friends and see them," she says.

Still, there are times when the realities of her budget can complicate her social life. She occasionally has to set boundaries about what she can and cannot afford.

"[Some of my friends] have been making nice, comfortable salaries for five years and don't have to think too much about budgeting, or at least not in the same way that I do on a research year stipend," she says. "It's a conversation where it's like, 'Tonight's not going to be an $80 dinner night for me' or 'We're going to grab dinner, but I'll just have a glass of wine — we're not doing two bottles.'"

Even though living on a razor-thin budget can sometimes be "frustrating," the sacrifices that Capellini has made haven't changed her desire to go into pediatric oncology.

Capellini considers herself "a product of so many people within medicine and the health-care system" who helped guide her through cancer survivorship and life as an amputee. Two decades since losing her leg to cancer, she is determined to pay back the kindness she received from her caretakers.

"When I think about having an opportunity to someday be in a care team that's taking care of a child who's facing a cancer diagnosis or limb loss, that is so meaningful and rewarding that I don't think too hard about the costs of getting there," she says. "That's still my guiding force."

What's your budget breakdown? Share your story with us for a chance to be featured in a future installment.

Sign up now: Get smarter about your money and career with our weekly newsletter

Don't miss: This 42-year-old quit his job with $1.2 million. Here's why he started working again 2 years later