Stocks Close Lower for a Fourth Day on Renewed Bank Worries, Dow Goes Negative for 2023: Live Updates

Stocks declined Thursday, as contagion fears in the regional bank space were reignited.

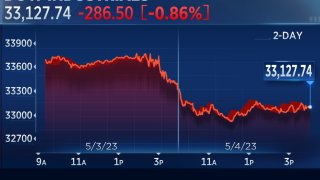

The Dow Jones Industrial Average fell 286.50 points, or 0.86%, to end at 33,127.74. The S&P 500 slid 0.72%, closing at 4,061.22. The Nasdaq Composite shed 0.49%, ending the day at 11,966.40. This was the fourth consecutive day of declines for the major indexes.

The Dow turned negative for the year on Thursday, pulling back 0.06% year to date. Declines in Boeing, Disney, Goldman Sachs and American Express shares dragged on the Dow.

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter here.

Shares of PacWest tanked by more than 50%. The decline came after news late Wednesday that the California bank has been assessing strategic options, including a possible sale, a person familiar told CNBC. Regional bank shares sold off hard, with the SPDR S&P Regional Bank ETF (KRE) dropping more than 5%. Western Alliance tumbled 38% and saw trading halted multiple times due to volatility. Meanwhile, Zions Bancorporation lost 12%.

Investors also digested the Federal Reserve's 25 basis point rate hike and commentary following its Wednesday meeting.

Keith Apton, managing director at UBS Wealth Management, said that the volatility in the banking sector will help the Fed's mission of cooling down the economy.

Money Report

"I think it's going to take care of the Fed's job. ... Regional lenders are going to have to constrain capital. I don't think that money is going to be flowing through the system nearly as easily in the back half of this year and that indirectly is going to cool down the economy, which is ultimately going to do the Fed's job by bringing inflation down," said Apton.

"So, I do not think that the Fed will have to raise rates any further the rest of this year, although tomorrow's data on the jobs reading will be important to watch," he added.

April's nonfarm payrolls report is due Friday at 8:30 a.m. ET, as well as numbers on the unemployment rate.

Gensler warns SEC is 'particularly focused' on potential misconduct

Securities and Exchange Commission chairman Gary Gensler warned investors that the enforcement agency was paying extra close attention to any potential misconduct.

"As I've said, in times of increased volatility and uncertainty, the SEC is particularly focused on identifying and prosecuting any form of misconduct that might threaten investors, capital formation, or the markets more broadly," Gensler said in a statement.

He released a similar statement on March 12, following the rapid collapse of SVB and Signature Bank.

— Christina Wilkie

Stocks mark fourth negative trading session Thursday

U.S. stocks closed lower Thursday.

The Dow Jones Industrial Average lost 286.5 points, or 0.86%. The index turned negative year-to-date for the first time in 2023, down 0.06%.

The S&P 500 and Nasdaq Composite lost 0.72% and 0.49%, respectively.

— Hakyung Kim

S&P 500 could fall 5% from current level, says chart analyst David Keller

As the market enters the seasonally weakest part of the year, 4,200 remains the key resistance level to watch on the S&P 500, according to David Keller, Chief Market Strategist at StockCharts.com. He sees the stock index dipping about 5% from current levels, however.

"We expect the S&P 500 to retrace back to previous swing lows around 3,800 as we continue through a pivotal earnings season," he told CNBC.

"Outside of mega cap technology and communication services, we're seeing the strongest trends in more defensive sectors like health care and consumer staples," he added. "As long as defensive sectors are thriving, this suggests limited upside for the major market averages."

— Tanaya Macheel

Truist upgrades consumer staples sector to overweight

Truist raised its rating on the consumer staples sector to overweight from neutral, saying that it is one of the top sectors in terms of relative price and earnings basis.

"Several of the companies continue to have good pricing power. The sector should also do well on a comparative basis if the economy slows, as we anticipate, given many of their products are necessities as opposed to discretionary," the firm wrote in a Thursday note.

Meanwhile, the firm is underweight on the financials, real estate and health care sector.

— Hakyung Kim

The next Fed loan officer survey will be 'critical,' says Jefferies

Jefferies is keeping a close eye on the Federal Reserve's next Senior Loan Officer Opinion Survey scheduled to be released May 8.

"The ongoing risk at regional banks, with the US regional banks index down 38% year to date, means that the next Fed loan officer survey will be critical to monitor. ... It is likely to give the doves on the FOMC the rationale they are looking for for a pause," analyst Christopher Wood wrote in a Thursday note.

Wood noted that the central bank hinted at a pause in its rate hiking path in its post-meeting statement on Wednesday. "The Fed funds futures are now discounting a pause in June, followed by 75bp of rate cuts by the end of this year," Wood added.

— Hakyung Kim

DA Davidson says this software stock has ‘Buffett-esque’ qualities and can surge nearly 40%

DA Davidson analyst Gil Luria initiated coverage of this "Buffett-esque" stock with a buy rating, saying the software provider for corporate sales and marketing teams is a "rare" value pick in the sector.

"[This stock has] a competitive moat, a track record of execution and substantial long-term opportunity," Luria wrote in a Wednesday note.

— Sarah Min

Apple reaches record against S&P 500

Apple is handedly beating the broader market, with the tech stock's relative outperformance against the S&P 500 reaching an all-time high.

The iPhone maker is slated to report earnings after the bell Thursday. Apple shares dipped 0.8% on the day.

— Fred Imbert, Gabriel Cortés

AMD shares jump to session highs following report

AMD shares reached a session high on Thursday after Bloomberg reported that the chipmaker was working with Microsoft on a new artificial-intelligence processor.

Microsoft is helping AMD to fund the initiative, Bloomberg reported, citing anonymous sources.

AMD declined to comment. A Microsoft representative did not immediately respond to a request for comment.

AMD shares were last higher by 9.4%.

— Jordan Novet

Goldman Sachs advises investors to be overweight in non-U.S. markets

In the case that markets avoid a recession, Goldman Sachs says interests rates will likely then rise, putting downward pressure on valuations. In this case, the bank tells investors to position themselves to position themselves in markets outside of the U.S.

"We continue to recommend an overweight in non-US markets which are cheap with a similar growth profile. Returns for dollar-based investors should also get a boost from a gradually lower dollar," several analysts wrote in a Thursday note.

The company added that it favors quality growth and stable margin businesses "together with some deep value – Energy, Natural Resources and European Banks." Our strategists in the US and Asia have a preference for quality and defensive equities as well.

— Hakyung Kim

Goldman Sachs advises investors to be overweight in non-U.S. markets

In the case that markets avoid a recession, Goldman Sachs says interests rates will likely then rise, putting downward pressure on valuations. In this case, the bank tells investors to position themselves to position themselves in markets outside of the U.S.

"We continue to recommend an overweight in non-US markets which are cheap with a similar growth profile. Returns for dollar-based investors should also get a boost from a gradually lower dollar," several analysts wrote in a Thursday note.

The company added that it favors quality growth and stable margin businesses "together with some deep value – Energy, Natural Resources and European Banks." Our strategists in the US and Asia have a preference for quality and defensive equities as well.

— Hakyung Kim

Is my money safe? Americans growing more concerned about bank deposits

A Gallup survey uncovered that consumers are growing increasingly fearful about the safety of their bank deposits. In a survey conducted from April 3-25, nearly half of those polled said they were "very worried" (19%) or "moderately worried" (29%) about their deposits, Gallup said.

The pollster said this latest reading is similiar to the findings it saw shortly after the collapse of Lehman Brothers on Sept. 15, 2008.

As a reminder, the Federal Deposit Insurance Corp. backs deposits of up to $250,000 per depositor at an insured bank. For those with accounts above the insured limit, there are steps one can take to protect their assets.

—Christina Cheddar Berk

J&J's consumer health spinoff Kenvue makes public market debut

Kenvue traded $25.53 per share during its market debut on the New York Stock Exchange Thursday, jumping 16% from its $22 IPO.

Kenvue's debut marks the largest U.S. IPO since 2021, when electric vehicle maker Rivian went public. The IPO is also the largest restructuring move in Johnson & Johnson's history. Johnson & Johnson will have a 90.9% stake in Kenvue after the IPO completes, and proceed reduce the rest of its stake later in 2023.

— Hakyung Kim

See the stocks making the biggest moves midday

These are the stocks making the biggest moves midday:

- Paramount Global — The media stock cratered more than 27% after the company slashed its dividend and reported earnings that fell short of analyst expectations. Paramount Global cut is dividend to 5 cents from 24 cents a share, marking its first reduction since 2009.

- PacWest, First Horizon, Western Alliance — Regional bank stocks were under heavy pressure again on Thursday. Shares of PacWest dropped more than 50% after reports that the company was exploring a potential sale. The company said it is evaluating all options to maximize shareholder value. Shares of First Horizon dropped more than 30% after its merger with TD Bank was called off, with the banks citing lack of clarity on a timeline from regulators. Western Alliance also suffered deep losses, falling more than 40%.

- Shopify — The e-commerce platform jumped more than 27% after beating expectations for the previous quarter and announcing a sale of parts of its fulfillment operation and logistics division.

— Alex Harring

First Horizon CEO says failed merger is unrelated to regional bank issues

First Horizon CEO Bryan Jordan said on "Squawk on the Street" that he takes it at "face value" that the failed merger with TD Bank was due to regulatory uncertainty and not a move by TD to backtrack on the deal given the decline in regional bank stocks. Jordan said he did not have insight into what the regulatory issues might have been.

"Any questions about the approval process, unfortunately, TD will have to answer," Jordan said.

The CEO of the Tennessee-based bank said that he believes the banking system is strong. Regulators should look at changes to the deposit insurance system, such as for large business accounts, to help stabilize the industry, Jordan said, but he added that short-term moves like banning short-selling might not be the best path.

"I don't think any spur of the moment decisions are usually good. I think it's probably time to take a breath and think through these things," Jordan said.

Shares of First Horizon are down 36% on the day.

— Jesse Pound

'Ripple effects of banking uncertainty will continue,' says Hirtle Callaghan

Mark Hamilton, chief investment officer at Hirtle Callaghan, says that the resurgence of instability in the banking sector are looking to continue for the foreseeable future.

"I think you are going to continue to see ripple effects. This is the nature of now had 475 basis points of tightening — those effects are going to ripple through the economy over time.," Hamilton said. "And that is definitely one of the contributors to what's going on with with the regional banks." Hamilton added that the flare ups in bank stocks are likely to continue on an "episodic" basis over the next few quarters.

To be sure, he added that he hesitates "to even call this a crisis."

"This is not like 2008, where you had such a systemic series of risks where many, many banks had issues with capital adequacy, etc. This seems to be to be much more focused in certain types of banks with certain types of customer bases that are the most vulnerable."

— Hakyung Kim

Qualcomm shares fall on weak guidance, sales

Shares of Qualcomm fell 7% after the chipmaker shared lighter-than-expected guidance and a 17% year-over-year decline in handset chip sales.

The company reported adjusted earnings of $2.15 a share, in line with Refinitiv estimates. Revenue came in at $9.28 billion, slightly above the expected $9.1 billion.

CEO Cristiano Amon attributed the results and forecast to a challenging environment, adding that the company's seen no signs of a smartphone sales recovery in China.

Some chip stocks fell along with Qualcomm. Skyworks Solutions, Teradyne, Micron Technology and Broadcom were last down at least 1% each.

— Samantha Subin, Kif Leswing

Western Alliance shares lose more than half their value, trading halted for volatility

Trading for Western Alliance Bancorp shares was paused multiple times on Thursday, as the stock plunged 58.2%. The move comes as regional banking peer PacWest Bancorp saw its stock lose 59% on news of exploring a sale. The SPDR S&P Regional Banking ETF lost more than 9% Thursday amid the uncertainty.

— Hakyung Kim

Every stock in closely followed regional banking index trades down

Every stock in the SPDR S&P Regional Banking ETF traded lower on Thursday as investors kept focus on the sector.

The fund as a whole lost more than 8% in trading on Thursday. Western Alliance and PacWest led the fund lower, with each shedding more than half of their respective share values during the session. Home BancShares, the best performer, was still down 0.7%.

As a whole, the index has tumbled around 41% since 2023 began.

— Alex Harring

Dow Jones Industrial goes negative for 2023, hurt Thursday by Boeing, Disney, Goldman

The Dow Jones Industrial Average went negative for the 2023 early Thursday, hurt most by declines in Boeing, Disney, Goldman, American Express, Caterpillar and JPMorgan, all of which contributed 15 points or more to the average's decline.

The 127-year-old average is now in jeopardy of falling below its 50-day moving average of 33,076.75 for the first time since March 31. The Dow will end the day negative for the year so long as it closes below 33,147.25.

The Dow's closing high for the year-to-date came on January 13, when it reached 34,302.61, up 3.49% from its close on the final trading day of 2022.

— Gina Francolla, Scott Schnipper

Citi upgrades this financial giant, sees sharp gains ahead after banking crisis

Citi analyst Andrew Coombs upgraded this beaten-down bank stock to buy/high risk, saying it has further upside after the firm's stronger-than-expected first-quarter results.

"[The] 1Q23 results demonstrated potential for further consensus earnings upgrades. In addition the company provided additional reassurance on the funding & liquidity position of the bank and on US CRE exposure," Coombs wrote.

— Sarah Min

Paramount drops more than 20% on disappointing earnings, dividend cut

Paramount Global shares tumbled nearly 22% after the media company shared weak earnings results that feel short of expectations and slashed its quarterly dividend to 5 cents a share.

Other media and entertainments stocks fell alongside Paramount, with shares of Fox Corporation, Walt Disney and DISH Network last down about 4% each. Warner Bros. Discovery slumped about 3%.

— Samantha Subin

Icahn Enterprises continues its slide

Shares of Icahn Enterprises resumed their slide on Thursday, down another 9% in morning trading. The stock has now fallen more than 40% this week alone.

The sell-off was triggered by notable short seller Hindenburg Research that took a short position against Carl Icahn's conglomerate.

Hindenburg on Tuesday released a report on Icahn Enterprises, alleging "inflated" asset valuations, among other reasons, for what it says is an unusually high net asset value premium in shares of the publicly traded holding company.

— Yun Li

Goldman Sachs says this building materials stock has pricing power and can jump 40%

Goldman Sachs upgraded this building materials firm after its strong first-quarter results, citing strong pricing power amid easing inflation.

Read more about the call here.

— Sarah Min

Traders nearly unanimous that the Fed has reached "terminal rate" and is done, per the CME

What a difference a day makes.

The odds that the current 5.00%-5.25% fed funds rate is indeed the peak (terminal rate) have now gone to 97% per the CME Fed Watch tracker -- up from 77% before yesterday's Federal Open Market Committee meeting, 62% a week ago and only 37% a month ago.

Chalk that up as one side effect of the continued, unresolved regional bank crisis. Or easier inflation. Or an economic slowdown.

P.S. — The missing 3%, you ask? Those hardy interest rate traders are not betting that the Federal Reserve benchmark will raise rates to 5.25%-5.50% in June. Oh no. Those happy few are counting on the Fed to cut rates back to 4.75%-5.00% at the June meeting. Only 41 days to go.

— Scott Schnipper

Nelson Peltz warns of more regional bank failures, the Financial Times reports

Longtime activist investor Nelson Peltz believes more regional banks could be in danger after the collapse of First Republic Bank, he told the Financial Times in an interview.

The co-founder and CEO Trian Fund Management said depositors with more than $250,000 should pay an insurance fee to the FDIC in order to protect smaller lenders.

"It should stop the deposit outflow from the small regional and community banks," Peltz said to the FT. "I don't think we want all of the funds just going to major banks."

— Yun Li

Cantor Fitzgerald CEO on the Fed: No hikes, but no cuts, either

The Federal Reserve is likely done for a while making interest rate moves either higher or lower, Cantor Fitzgerald CEO Howard Lutnick said Thursday.

A rush of deposits out of banks in recent months has served as the equivalent of 100 basis points of increases, negating the need for the central bank to do more to fight inflation, the financial services chief told CNBC's "Squawk Box."

"Of course they're done. They're not pausing," he said. "You think they raised yesterday and they're going to cut this year? Here's my call: Stays the same. Remember, if the money is coming out of the banking system, raising rates doesn't change as much. They're just going to stay steady Eddie."

—Jeff Cox

Homebuilding stocks within S&P 500 hit new high

The S&P 500 Homebuilding Index hit a new all-time high, completing erasing the more than 40% slide seen in recent years.

The index finished Wednesday at $2,039.76, which is a new high. Excluding recent weeks, it last broke the $2,000 mark in late December of 2021.

But the index slid between December 2021 and it's new high seen Wednesday, making a V-shape. It was more than 40% off its current high at the trough in late June of 2021.

PulteGroup, NVR, Lennar and D.R. Horton are all part of the index.

— Alex Harring

Claims, productivity, labor costs and trade data miss estimates

A round of economic data points Thursday morning mostly came in worse than Wall Street expectations.

Jobless claims totaled 242,000 for the week ended April 29, higher than the 236,000 estimate from Dow Jones. Worker productivity in the first quarter declined 2.7% against the estimate for a 1.9% drop, while unit labor costs, an inflation gauge, accelerated 6.3% in Q1, higher than the 5.5% expectation.

Finally, the trade deficit declined to $64.2 billion, but that was higher than the $63.1 billion estimate.

—Jeff Cox

ECB hikes rates a quarter point as expected

The European Central Bank on Thursday raised interest rates by a quarter percentage point, in line with market expectations, noting that inflation is still too high and underlying pressures persist.

A day after the U.S. Federal Reserve announced a similar hike, the ECB took its key borrowing rates up to a respective 3.75%, 4% and 3.25%, near a 15-year high. The Fed's move brought its fund rate to a target range of 5%-5.25%.

Headline inflation is running around 7% in the euro zone, well above the ECB's 2% target.

—Jeff Cox

Regional bank stocks under pressure again

Thursday is shaping up to be another rough session for regional bank stocks, with shares of several lender poised to suffer large drops when the market opens.

The stocks of First Horizon and PacWest have both dropped about 40% in premarket trading. Western Alliance has slid 17%.

The SPDR S&P Regional Banking ETF (KRE) sank by 4.2%.

— Jesse Pound

See the stocks making the biggest moves before the bell

These are some of the stocks making the biggest premarket moves:

- Paramount Global – The media company dropped 10.4% after reporting quarterly profit and revenue that missed Wall Street forecasts. Paramount also slashed its quarterly dividend to 5 cents per share from 24 cents.

- PacWest Bancorp – PacWest tumbled 37% in premarket trading after the banking company said it was considering various strategic options. The bank said it had not seen any acceleration in deposit outflows since First Republic Bank was sold to JPMorgan Chase earlier this week.

- Shopify – Shopify gained 15.6% in the premarket. The e-commerce platform reported-better-than expected quarterly results and also announced the sale of parts of its fulfillment operation as well as its logistics division.

— Peter Schacknow

Shopify shares pop as company announces logistics business sale, new layoffs

Shopify shares surged nearly 18% on Thursday as the e-commerce company announced that its selling its logistics business to supply chain technology company Flexport and a new round of layoffs.

As part of the deal, Shopify will get stock representing a roughly 13% equity interest in Flexport. The company will also serve as Shopify's official logistics provider.

Shopify announced first-quarter results before the bell that beat analyst expectations. That included a surprise earnings beat. The Canadian company also said it will cut 20% of its workforce.

— Annie Palmer, Samantha Subin

VIX ticks higher again after jumping a day earlier

The CBOE Volatility Index, or VIX, ticked higher again on Thursday after climbing 5.5% a day earlier.

The key gauge of market uncertainty stood at 19.28 before the 9:30 opening bell, and climbed as high as 19.42 earlier Thursday morning.

Guidance from Federal Reserve chair Jerome Powell left investors somewhat hopeful that the central bank could be done with its tightening cycle. Still, Powell remained resolute that inflation is still too high and a 2% target remains the goal of the Fed.

— Brian Evans

J&J spinoff Kenvue starts trading Thursday at $22 per share

Johnson & Johnson's consumer health business Kenvue is expected to start trading on the New York Stock Exchange Thursday, in one of the largest IPOs in more than a year.

The new company, which will trade under the ticker symbol KVUE, priced its IPO at $22 per share Wednesday. The price, toward the high end of the stated range, will bring in about $3.8 billion and values the company at around $41 billion.

Kenvue's products include Band-Aid, Tylenol, Neutrogena and J&J's baby powder and shampoo.

— Michelle Fox, Annika Kim Constantino

Paramount slumps on disappointing earnings

Paramount Global shares tumbled more than 10% before the bell after the media company missed earnings expectations for the recent quarter on the top and bottom lines and showed continued advertising softness.

The Berkshire holding reported adjusted earnings of 9 cents a share on $7.27 billion in revenue. That fell short of the EPS of 17 cents and revenue of $7.42 billion expected by analysts.

Paramount also cut its dividend from 24 cents to 5 cents a share.

Revenues at the company fell 8% from a year ago, driven largely by an 11% year-over-year drop in advertising revenues.

— Samantha Subin

First Horizon falls 40% after TD Bank merger is called off

Shares of First Horizon dropped 40% in the premarket after the company and TD bank agreed to terminate a merger that was announced in early 2022. As part of the termination agreement, TD will pay First Horizon $200 million.

"While today's announcement is unfortunate and unexpected, First Horizon will continue on its growth path operating from a position of strength and stability," First Horizon CEO Bryan Jordan said in a statement.

— Fred Imbert

'Big 3' drivers for optimism remain, Vital Knowledge says

Stocks ended Wednesday's session sharply lower and were headed for a muted open after the Federal Reserve's latest rate hike and news that PacWest was exploring options — including a sale.

However, Vital Knowledge's Adam Crisafulli said his "Big 3" drivers for optimism are still in place. These drivers are earnings, "inflation/monetary inflection point" and sentiment.

"While earnings reports Tues night, Wed morning, and Wed night contained some clunkers (including poor guidance from EL and QCOM), the season overall remains bullish," he wrote. "In addition to earnings, monetary policy and inflation globally are at an important dovish inflection point (a view underscored by the Fed's Wed decision) while sentiment is still extremely negative."

— Fred Imbert, Michael Bloom

Europe stocks open lower

European stock markets fell in early trade, with the benchmark Stoxx 600 index down 0.8% at 8:24 a.m. London time.

Investors are bracing themselves for the a rate hike decision from European Central Bank and are processing a slow of corporate earnings from the likes of Shell, Airbus, Volkswagen and Anheuser-Busch InBev.

France's CAC 40 and Germany's DAX were both down around 0.8%, while the U.K.'s FTSE 100 shed 0.6%.

— Jenni Reid

China's Caixin manufacturing PMI marks first contraction in three months

China's manufacturing activity slipped into contractionary territory for the first time in three months as the Caixin manufacturing purchasing managers' index came in at 49.5 in April, below estimates.

The reading also marks a drop from March's 50.0 level and reflects downsizing in new orders.

"This suggests that China's economic recovery significantly slowed after Covid-19 infections peaked at the start of this year, given that the index stood at 51.6 and 50 in February and March, respectively," Caixin Insight Group's senior economist Wang Zhe said in the release.

Still, businesses were confident that demand will pick up later in the year.

"Manufacturers remained highly optimistic, with the reading for their expectations for future output in April significantly higher than the long-term average, as they expressed strong confidence in market demand recovery and the implementation of relevant supportive policies," Wang said.

— Jihye Lee

Australia trade surplus widens to AU$15.27 billion in March

Australia's trade surplus came in at AU$15.27 billion ($10.2 billion) in March, higher than the AU$14.15 billion recorded in February, government data showed on Thursday.

The reading was higher than expectations of a decline to AU$12.65 billion in March, according to a Reuters poll.

The country's statistics bureau revealed that exports rose 3.8% month on month to A$59.3 billion, driven by metal ores and minerals.

Imports increased 2.5% month on month to AU$44.02 billion, mainly due to non-industrial transport equipment.

— Lim Hui Jie

More investors expect a correction, according to the latest Investors Intelligence survey

The percentage of financial newsletter editors in the U.S. expecting a correction (short term weakness) in the stock market rose to 30.6% in the latest weekly survey, up from 26.4% last week.

Bullish opinion declined again, to 45.8% from 48.6% last week and 50.7% two weeks ago, which was the highest reading since November 2021, shortly before prices peaked in January 2022.

Bearish opinion narrowed as well, dropping to 23.6% from 25% last week.

Sentiment surveys are contrarian indicators. The more optimism found, the greater the risk in stocks. The greater the pessimism, the less risk.

— Scott Schnipper

PacWest tumbles after hours on report bank is weighing sale

PacWest Bancorp shares tumbled 57% in extended trading on Wednesday following a report that the bank is weighing strategic options.

The regional bank has been assessing options, including a possible sale, CNBC confirmed, according to one person familiar with the matter.

Bloomberg first reported the news late Wednesday.

— Sarah Min

Correction: A source familiar told CNBC that the regional bank's options include a potential sale – not a capital raise.

Stocks making the biggest moves after hours

Check out the companies making headlines after hours:

- PacWest, Western Alliance, Comerica - Shares of PacWest plunged more than 50% in extended trading following a Bloomberg News report that the regional bank was exploring strategic options, including a potential sale. The news weighed on other mid-sized banks as well. Shares of Western Alliance dropped 27%. Valley National's shares slid 13%, and Comerica fell nearly 12%.

- SolarEdge Technologies — SolarEdge Technologies jumped about 9% after beating first-quarter expectations on the top and bottom lines. The firm reported adjusted earnings of $2.90 per share against a $1.92 estimate, on revenue of $944 million that topped a $933 million consensus, according to analysts polled by Refinitiv.

- Etsy — Etsy jumped 6.7% after beating first-quarter revenue expectations. The online marketplace focused on handmade goods reported revenue of $641 million, topping the estimate of $622 million, according to consensus data from Refinitiv. Per-share earnings of 53 cents matched expectations.

Read the full list here.

— Sarah Min

Stock futures open lower

Stock futures fell after the Federal Reserve hiked rates by another 25 basis points and investors' fears of contagion in the regional bank space returned.

Futures linked to the S&P 500 shed 0.5%. Nasdaq 100 futures declined 0.25%, and futures linked to the Dow Jones Industrial Average dropped 152 points, or 0.45%.

— Darla Mercado