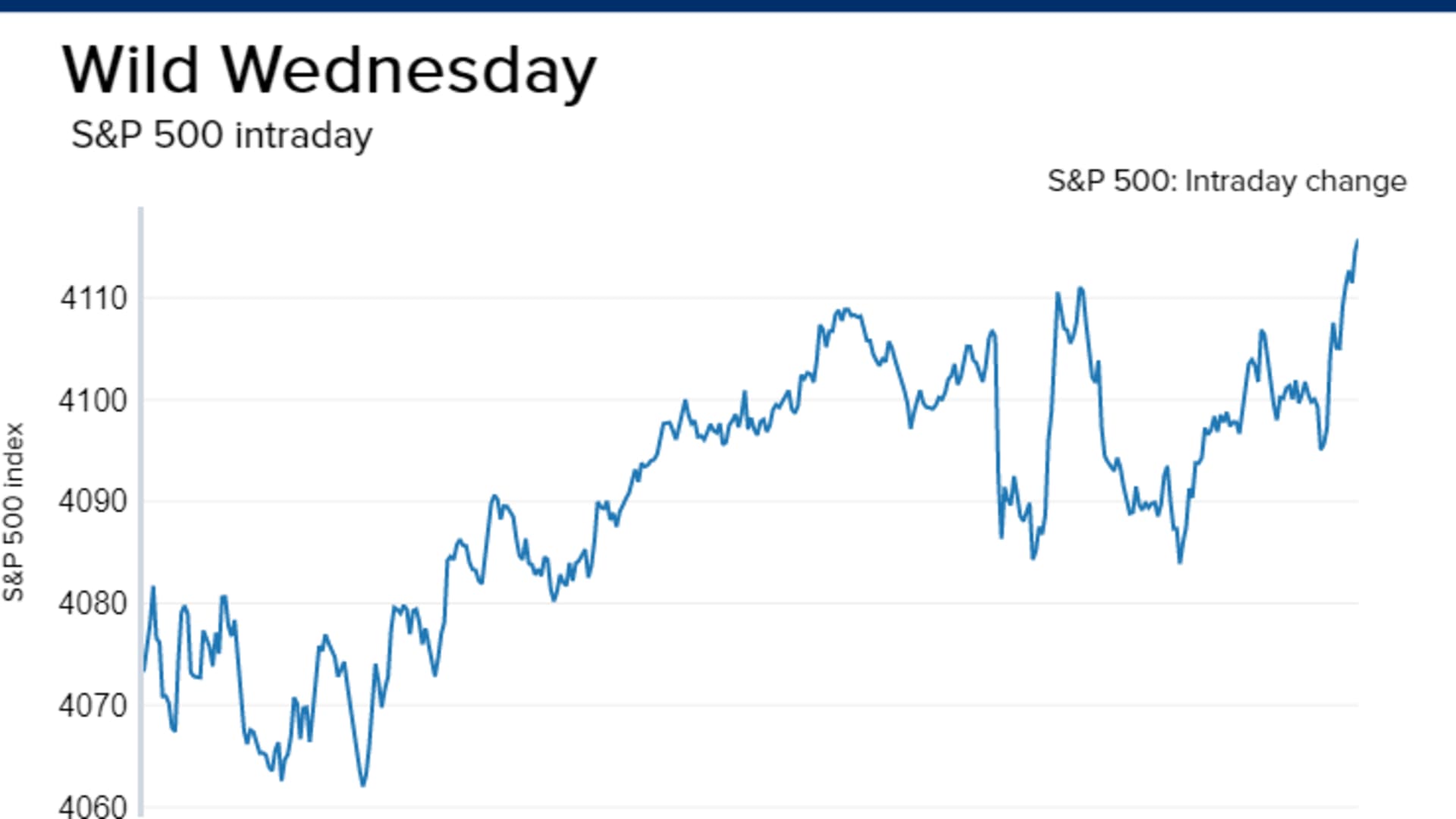

U.S. stocks cut sharp losses and ended the wild session far off their lows on Wednesday as cryptocurrency prices largely recovered, but the weakness in speculative pockets of the market still weighed on sentiment.

The Dow Jones Industrial Average closed 164.62 points lower, or 0.5% to 33,896.04 after dropping 586 points at its low of the day. The S&P 500 fell 0.3% to 4,115.68 as nine out of 11 sectors registered losses. The tech-heavy Nasdaq Composite rebounded from a 1.7% loss earlier and closed flat at 13,299.74 as some of the major tech stocks reversed higher including Facebook, Netflix, Microsoft and Alphabet.

The major averages briefly added to their losses in afternoon trading after the Federal Reserve's minutes from its April meeting hinted at reconsidering its asset purchase programs in upcoming meetings.

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter here.

Wall Street had another wild session with tech stocks sliding in the morning as investors were rattled by a sudden plunge in cryptocurrencies, including bitcoin. Later the weakness spilled over into other sectors with the S&P 500 dropping 1.6% at its session low. The exception was a handful of retailers that reported solid earnings, including Target.

The world's largest digital token plunged 30% at its low of the session to just above $30,000, according to Coin Metrics. On Tuesday, China warned financial institutions not to conduct crypto-related business, possibly sparking the sell-off.

Money Report

The cryptocurrency recovered most of the decline in afternoon trading and was last down 7%. The major averages later recouped some of their losses, as bitcoin prices bounced back.

Tech stocks linked to bitcoin saw the biggest declines in the sector. Tesla, a big holder of bitcoin, declined 2.5%. MicroStrategy, another company that bought a large amount of bitcoin for its corporate treasury, tanked by 6.6%. Coinbase, the newly public crypto exchange, tumbled nearly 6%.

"There is no question that bitcoin has been the poster child for rampant market speculation and risk appetite," said Peter Boockvar, chief investment officer at Bleakley Advisory Group. "It should be absolutely monitored in gauging the pulse of risk taking, and now risk aversion."

Growth stocks have come under pressure lately with the Nasdaq Composite falling nearly 5% in May as fears of inflation intensified. A sustained pickup in price pressures could unravel the Federal Reserve's accommodative policies, which could hurt technology companies that have relied for years on easy borrowing costs for superior growth.

Cathie Wood's flagship fund Ark Innovation ETF (ARKK) dropped 1.7%, bringing its 2021 losses to more than 17%.

"This was bound to happen at some point in '21 and a somewhat of a reset in crypto-pricing is likely more healthy vs negative for the broader equity markets over time," Jordan Klein, an analyst at Barclays, said in a note.

Fed hinted at tapering

The Fed's minutes said a strong pickup in economic activity would warrant discussions about tightening monetary policy in the coming months.

"A number of participants suggested that if the economy continued to make rapid progress toward the Committee's goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases," the Fed minutes said.

Chairman Jerome Powell said after the meeting that the recovery remains "uneven and far from complete" and the economy was still not showing the "substantial further progress" standard the committee has set before it will change policy.

"The market right now is being strong based on this tremendous liquidity. Everybody is fearful of when that liquidity starts to go away. Those comments indicate that at some point, the Fed is going to talk about — at some point taking some of those liquidities away. We think the market is just very sensitive to that," David Katz of Matrix Asset Advisors said on CNBC's "Power Lunch."

Helping the sentiment a bit on Wednesday was better-than-expected results from Target. Shares of the major retailer popped by 6% after it said sales surged 23% last quarter.

Major stock indexes came off back-to-back losses weighed by weakness in the technology sector. Soft housing data on Tuesday partly triggered the broad selling in the previous session.

— CNBC's Kevin Stankiewicz contributed reporting.

Become a smarter investor with CNBC Pro.

Get stock picks, analyst calls, exclusive interviews and access to CNBC TV.

Sign up to start a free trial today