Some of 2020's top stocks are down on their luck.

Red-hot plays including Zoom Video Communications and Chewy tripped up last week as the reopening trade took hold on Wall Street, with some seeing double-digit losses:

- Biogen was down more than 24%

- Beyond Meat lost almost 20.5%

- Zoom fell by more than 19%

- DocuSign slid 11%

- Chewy declined over 10%

- Nvidia shed nearly 9%

For one of these names, the rough patch may have just been a bout of bad luck, two traders said.

While Nvidia is "certainly expensive," trading at a historically high relative price-sales ratio, the chipmaker's "secular growth story is hard to argue with," Nancy Tengler, chief investment officer of Laffer Tengler Investments, told CNBC's "Trading Nation" on Friday.

"It's priced to perfection," she said. "I might wait for it to settle a little bit further, but if they beat dramatically on earnings, you may not get the opportunity. So, you might want to dollar-cost average in."

Money Report

Investors may be paying up for future sales, but with cloud computing, artificial intelligence and gaming making up nearly 90% of Nvidia's business, the shares "can run a long way for a long time," Tengler said.

"With a stock that's up 126% year to date, you're going to expect to see that kind of volatility, but it has not disappointed long-term investors," she said. "I would say be nimble in the near term. If you bought some, buy a little bit more because this story is not going away and it's in the best part of the tech space and I think that's where you want to be, reopening or not."

Craig Johnson, senior technical research analyst at Piper Sandler, was also in Nvidia's bull camp.

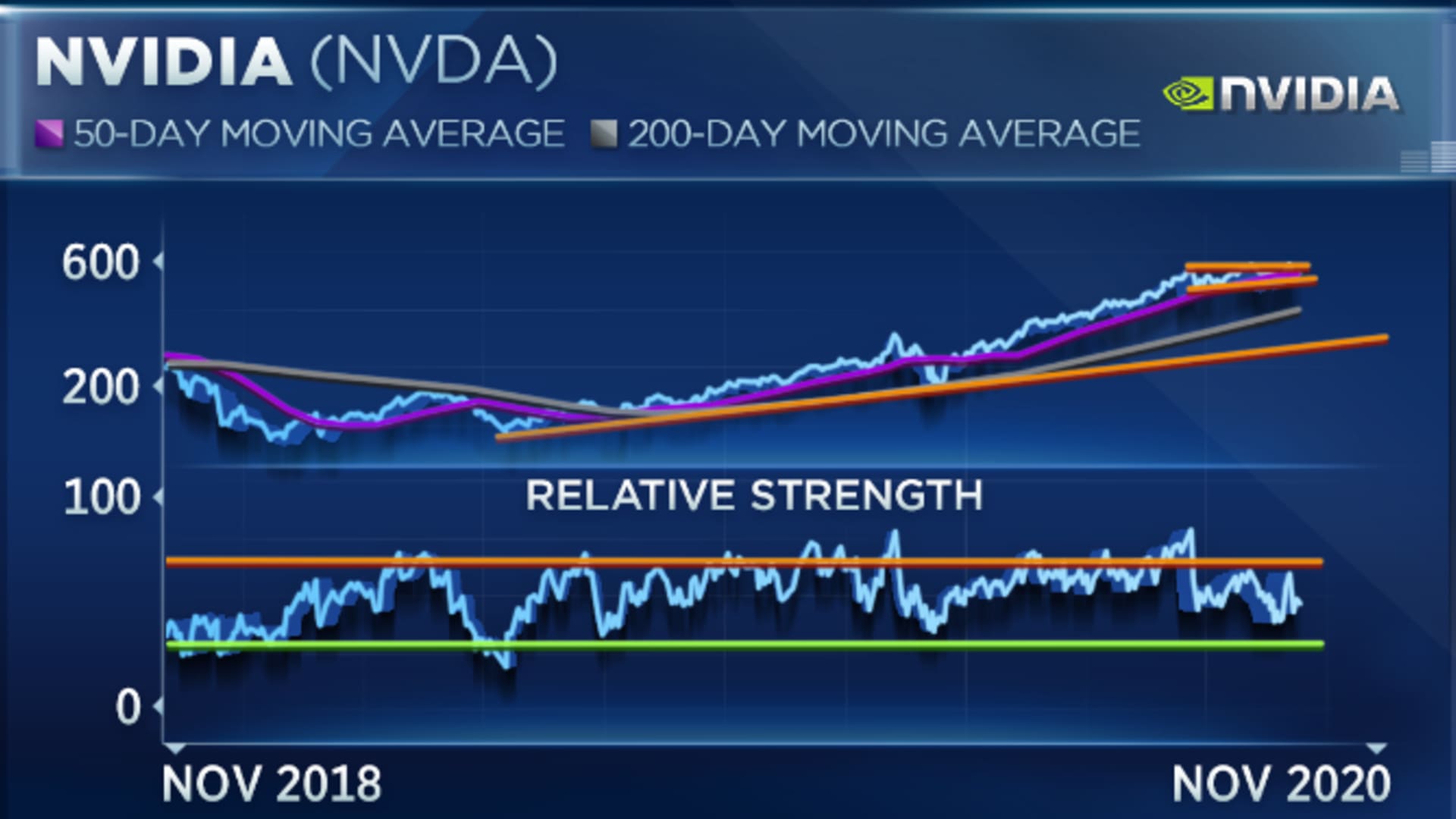

"The longer-term trend still remains higher and it looks like ... the stock is just sort of consolidating at this point in time after having had a very nice move," he said in the same "Trading Nation" interview, pointing to the chart.

"I would typically look at a stock like this and say we've entered sort of a high-level trading range ... and that looks like, to us, just to be a consolidation pattern with the primary trend going higher," he said. "I would be a buyer of the stock into the earnings print as, again, I think this is a stock that's got a great track record of beating both on the top and bottom line."

Chewy could also claw its way back from last week's rough patch, Johnson said.

"This is a stock, from our perspective, that still remains in a well-defined uptrend at this point in time and all we're doing is sort of retesting the lower end of that upper-trending channel," he said.

Piper Sandler analyst Peter Keith initiated coverage of Chewy on Friday with an overweight rating and $90 price target, calling its long-term growth forecast "highly attractive." Chewy shares closed less than 1% lower on Friday at $62.99.

"I think the fundamentals and the technicals align here and this looks like a stock that we should be buying here at these levels," Johnson said. "I think at minimum, just based upon the charts, you've got to move up to about $80, so, about 26-27% upside from here."

Nvidia is scheduled to report earnings after Wednesday's closing bell.

Disclosure: Piper Sandler is a registered market maker for Nvidia.