Still waters run deep.

The S&P 500 may have barely moved over the past week, but Oppenheimer's head of technical analysis, Ari Wald, said this is part of a familiar pattern for markets that could set the stage for a more energetic end to the year.

"Over the last 30 years, there has been a tendency for the market to pause in mid-November ahead of a resumption of strength in December into year-end," Wald told CNBC's "Trading Nation" on Monday.

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter here.

Wald said this consolidation is a "simple reminder" that bull markets do not always move in a straight line and that sideways action can be a normal and needed process.

"The more important positive for us is what we're seeing in our internal breadthwork as well as our leadership indicators as well that corroborates this bull market that we think that we're still in," he said.

Money Report

Gina Sanchez, chief market strategist at Lido Advisors, said a market pause makes even more sense this year beyond the seasonality.

"If you look at valuations, if you look at earnings, if you look at expectations for GDP growth, while all are positive without a doubt, they are slowing. And the markets simply have not yet figured out what the pandemic reopening is actually going to look like," Sanchez said during the same interview.

After falling nearly 14% in 2020, S&P 500 earnings are expected to rebound 48% this year, according to FactSet. That pace is expected to slow to 8% growth in 2022.

Sanchez said high valuations have pushed her toward a "GARP" strategy – investing in growth stocks at a reasonable price. The S&P 500 trades at 21.6 times forward earnings.

"The market should take a step back and ask itself, 'Am I paying a reasonable price for the growth that I'm expecting?'" said Sanchez.

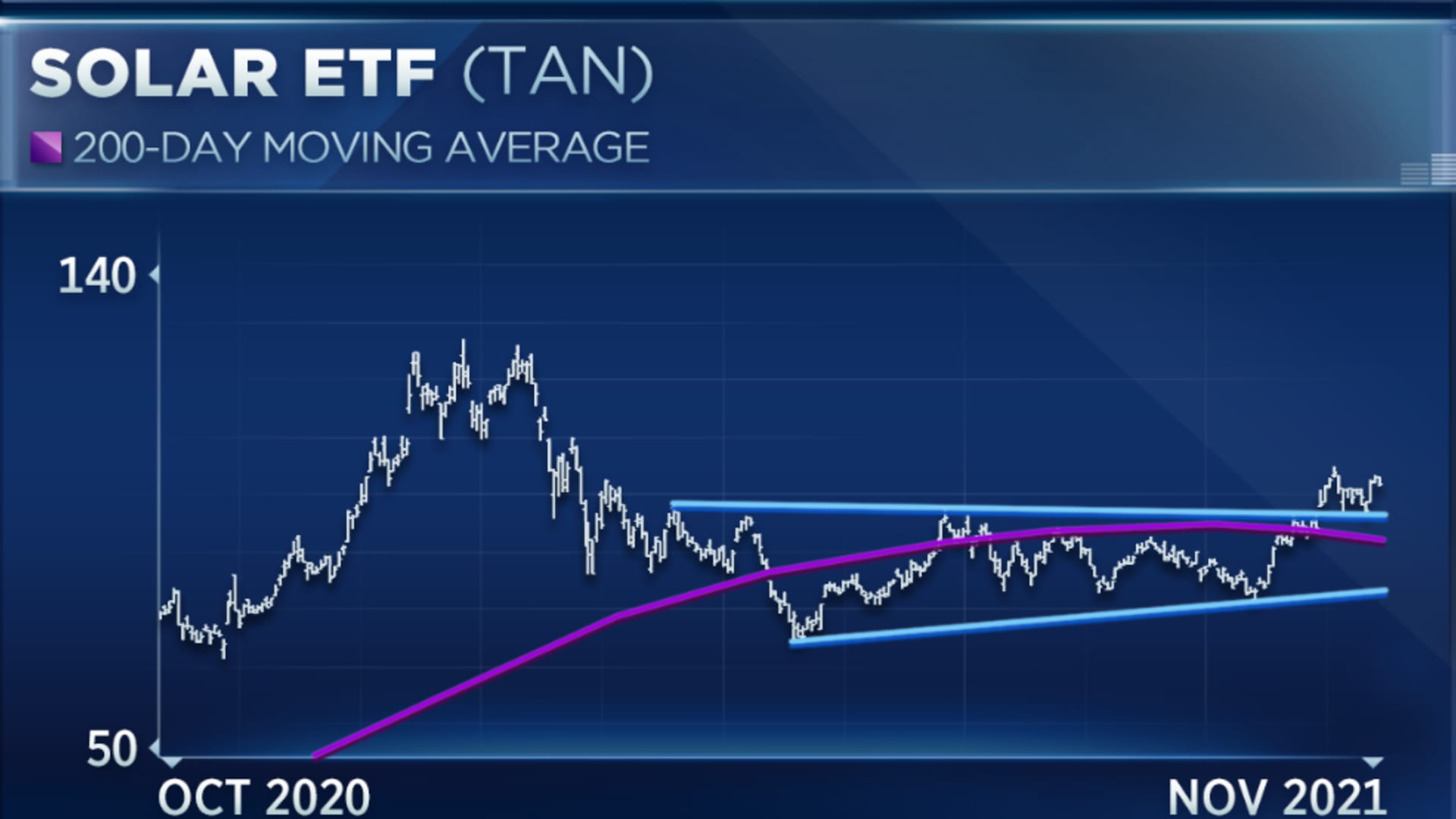

Wald, meanwhile, looks to the alternative energy space for opportunity during the market's calm. He highlights the TAN solar ETF as one potential spot.

"The ETF completed its six-month base, it broke out to the upside coming into the month. It's been more stagnant of late. It has chopped around. We want to buy this pause ahead of a resumption of strength. Our assumption is that that ETF should trade higher as long as the breakout is intact above $92 support," Wald said.

The TAN ETF has risen 12% over the past month, though remains nearly 23% from a high set in January.