- Microsoft beat expectations on the top and bottom lines.

- Fourth-quarter revenue guidance for each of the company's three business segments surpassed the expectations of analysts surveyed by StreetAccount.

- The company announced plans in the quarter to buy Activision Blizzard for almost $69 billion.

Microsoft shares surged as much as 6% in extended trading on Tuesday after the software maker issued fiscal third-quarter earnings that exceeded analysts' expectations and an optimistic outlook for the current quarter.

Here's how the company did:

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter here.

- Earnings: $2.22 per share, adjusted, vs. $2.19 as expected by analysts, according to Refinitiv.

- Revenue: $49.36 billion, vs. $49.05 billion as expected by analysts, according to Refinitiv.

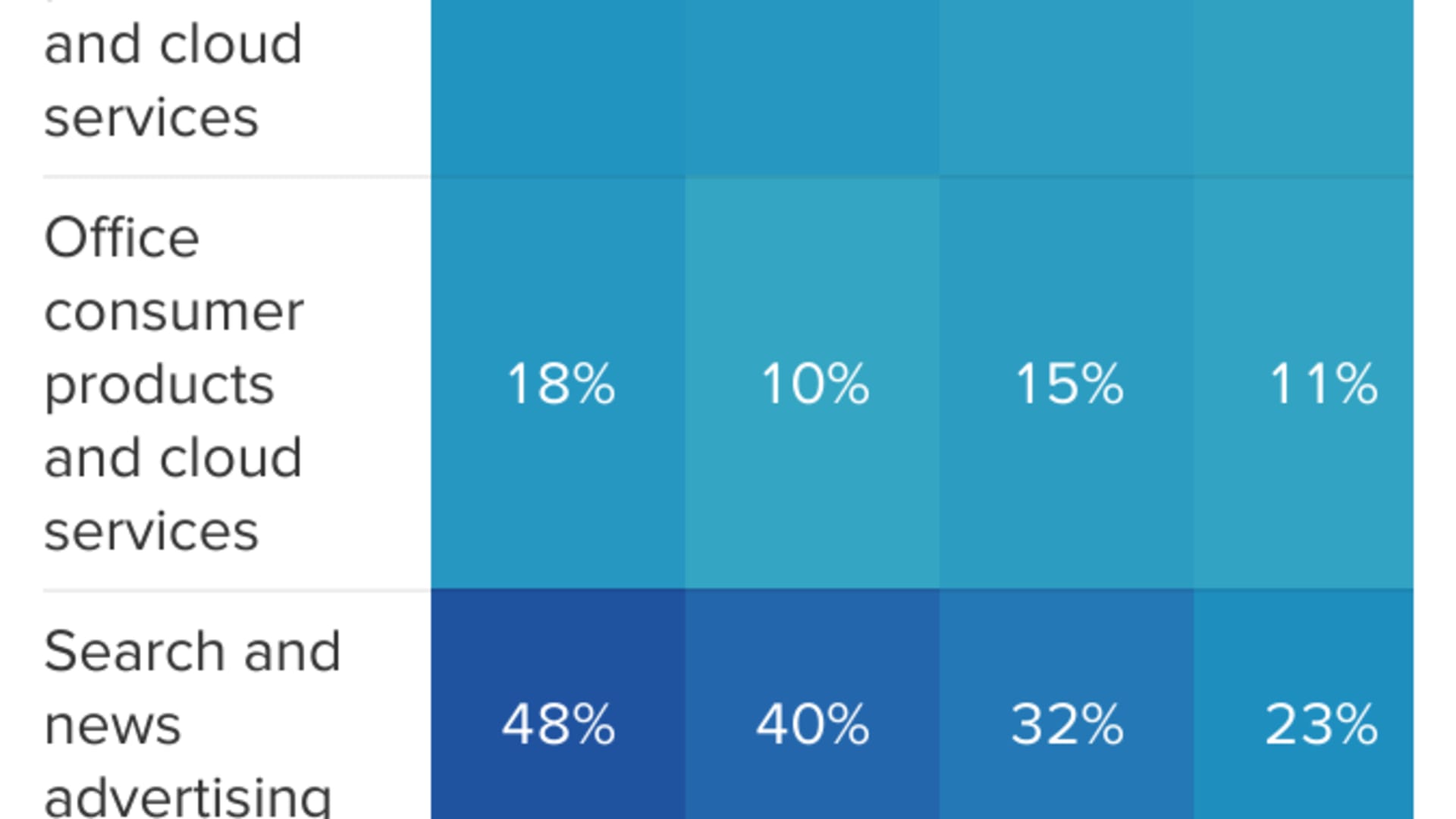

Microsoft's revenue increased by 18% year over year in the quarter, which ended on March 31, compared with 20% in the previous quarter, according to a statement. Microsoft turned in the smallest revenue beat since 2018, exceeding the consensus by less than 1%. Sales and marketing expenditures totaled $5.6 billion, 10% higher than the year-ago quarter and the fastest growth in more than three years.

Amy Hood, Microsoft's finance chief called for fiscal fourth-quarter revenue of $52.4 billion to $53.2 billion on a conference call with analysts. Hood's revenue guidance for each of the company's three business segments surpassed the expectations of analysts surveyed by StreetAccount. But the middle of the range for total revenue, at $52.8 billion, is just below the $52.95 billion consensus among analysts polled by Refinitiv.

Money Report

The company's Intelligent Cloud segment, which contains Microsoft's Azure public cloud for application hosting, along with SQL Server, Windows Server and enterprise services, generated $19.05 billion in revenue. That's up 26% and above the $18.90 billion consensus among analysts polled by StreetAccount.

Revenue from Azure and other cloud services jumped 46% in the quarter, compared with 46% growth in the prior quarter. The expectation was 45.3%, according to a CNBC survey of 13 analysts, while analysts polled by StreetAccount had been looking for 43.6% growth.

The number of Azure deals worth at least $100 million in the quarter more than doubled, CEO Satya Nadella told analysts on the conference call.

Microsoft's Productivity and Business Processes segment, containing Office productivity software, LinkedIn and Dynamics, posted $15.79 billion in revenue in the quarter, up about 17% and slightly more than the StreetAccount consensus estimate of $15.75 billion. Microsoft raised the prices of certain Office 365 productivity software subscriptions during the quarter.

The More Personal Computing Segment, which includes Windows, Xbox, search advertising and Surface, kicked in $14.52 billion in revenue, up 11% and higher than the $14.27 billion StreetAccount consensus.

Microsoft said revenue from Windows license sales to PC manufacturers increased 11% in the quarter. Microsoft had projected high-single-digit growth in January. Research firm Gartner estimated that PC shipments fell 6.8% in the quarter, marking the sharpest decline since the first quarter of 2020, after a pandemic-fueled market expansion. Shipments rose by 3.9% excluding computers running Google's Chrome OS operating system, which became more popular during Covid.

Revenue from security products and services falls under each of Microsoft's three segments. Microsoft said in January its security revenue grew nearly 45% in 2021, faster than any other major product category. The company disclosed financial figures from its security business for the first time last year, surprising some observers.

Microsoft announced a plan during the quarter to acquire video-game publisher Activision Blizzard for $68.7 billion, the largest transaction in Microsoft's 47-year history. Microsoft also closed its Nuance Communications acquisition and laid out a strategy for expanding in health care, an industry Nuance focuses on. Nuance took away a penny from Microsoft's quarterly earnings but added $111 million in revenue.

Excluding the after-hours move, Microsoft stock has declined 19% since the start of 2022, underperforming the S&P 500 index, which is down about 12% over the same period.