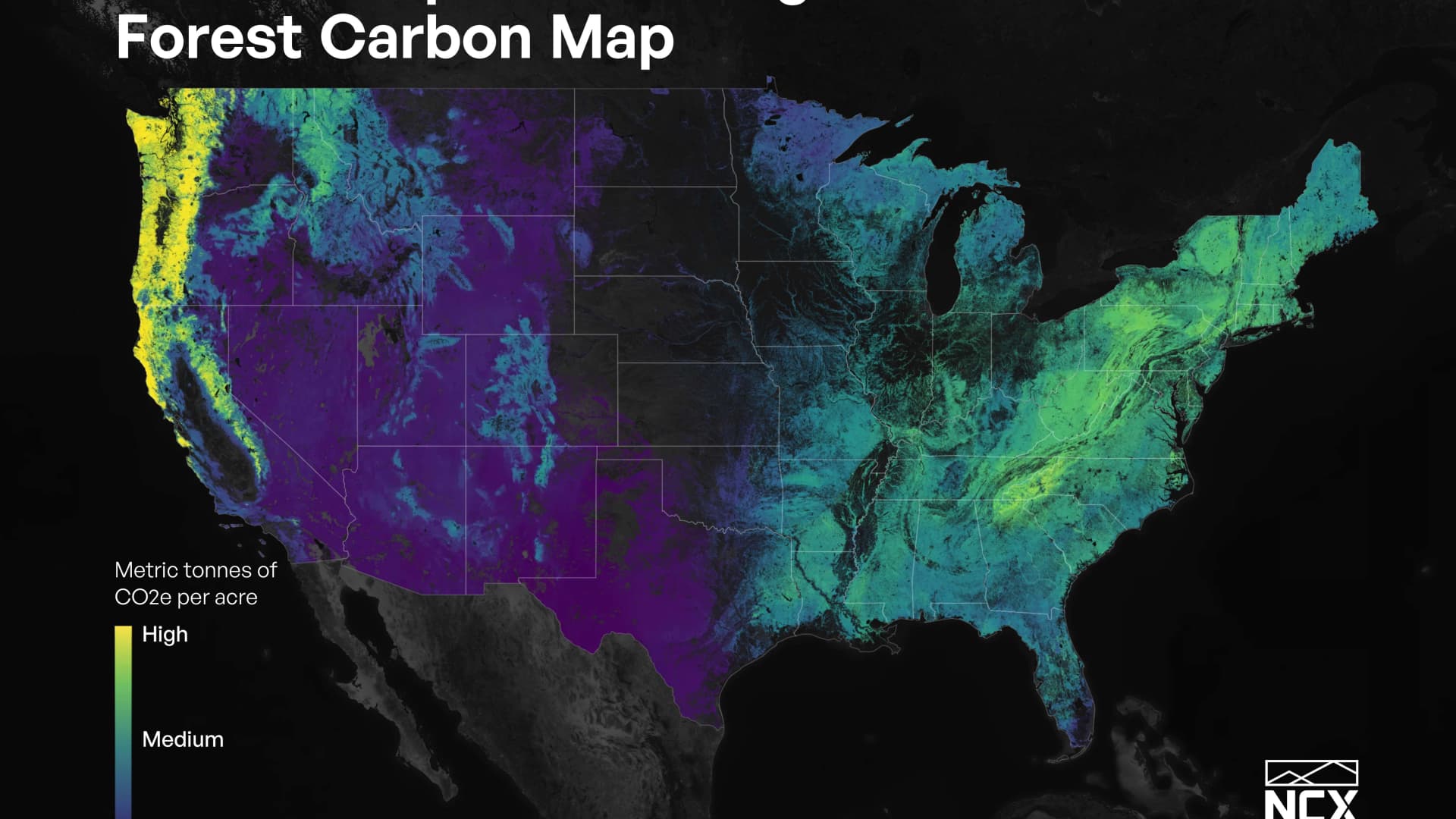

- NCX uses satellite imagery to generate high-resolution images of forests in the United States.

- The start-up's business is connecting landowners with trees on their property, and companies looking to achieve their net-zero emissions goals. It pays landowners not to cut the trees, then lets companies buy the resulting carbon offsets.

- On Wednesday, NCX announced it raised $50 million from a number of investors, including Marc Benioff's investment fund, Time Ventures, and J.P. Morgan.

A project launched by a couple of students who met studying forestry at Yale a dozen years ago has turned into a fast-growing start-up with the support of Salesforce leader Marc Benioff, who sits on its board.

NCX co-founders Zack Parisa and Max Nova used satellite imagery and machine learning software to generate a high-resolution image of the forest inventory in the United States, which they first sold to federal agencies like the United States Forest Service and conservation groups like The Nature Conservancy.

Now, they're taking that expertise and using it to fight climate change by facilitating the market for carbon offsets — a sort of voucher representing a certain amount of carbon dioxide that is being absorbed, or not emitted into the atmosphere. A company can claim to be "net zero" even if it is still releasing greenhouse gas emissions, as long as it has paid for sufficient carbon offsets to balance out remaining emissions.

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter here.

Trees absorb carbon dioxide. If landowners vow to keep trees alive instead of chopping them down to sell for timber, they can sell the resulting carbon offsets to companies looking to make good on their net-zero goals. NCX's software helps landowners map the trees on their property so they can account for how much carbon dioxide they are absorbing, giving companies more confidence that the carbon offsets they're buying are legit.

In addition to making tree-mapping software, NCX has created a marketplace where it brings together forest landowners with companies looking to buy the resulting carbon credits. NCX then makes money by taking a percentage of the purchase price of the carbon offsets.

"Our job as a company is to help make it so that every landowner in the United States can sell the carbon from their forests to help meet this just skyrocketing demand," Nova told CNBC on Monday.

Money Report

The voluntary carbon offset market is not regulated, and has been abused by companies seeking an easy public relations win, in a form of "greenwashing."

Parisa believes accurate measurement can help fix this problem.

"How we design and measure forest carbon projects hasn't always lived up to the potential or the intentions — with many failing to drive real climate impact," the CEO wrote in a blog post in May. "Not unlike the 'horseless carriage' or mobile phone, we can't stop at our first designs. It's time forest carbon projects do the same."

On Wednesday, NCX announced it had raised $50 million from a number of investors including Benioff's investment fund, Time Ventures, and J.P. Morgan. It will use that money, part of the $74.4 million it's raised in total, to grow outside of the United States and to develop software management tools for other natural resources besides trees.

"We called the company the Natural Capital Exchange, and not the Forest Carbon Exchange, because there's all sorts of things that we want more of or less of in the woods: We want more carbon, less wildfire, more animal habitat, less erosion. And so carbon for us is really step one," Nova said.

The company is also hiring rapidly. In the last year, the team has grown from 10 to 50 people, and expects to have 100 employees by the end of 2022.

The voracious demand for carbon offsets

The voluntary carbon market is relatively small, but it's growing quickly. In 2021, the voluntary carbon offsets market topped $1 billion, according to data published in November by the nonprofit environmental finance organization Forest Trends & Ecosystem Marketplace. That's up significantly from $473 million in 2020, which was up from $320 million in 2019.

Parisa and Nova began their move toward the carbon offset market in 2018, when they got accepted into Microsoft's AI for Earth program. NCX worked with Microsoft's planetary computer to prototype and build out Basemap, a high-resolution forest inventory of the United States.

With that, NCX was able to launch a pilot program in Pennsylvania giving landowners a way to get paid for not harvesting timber on the land they own.

Before the NCX software was introduced, only four of the approximately 19,000 landowners in McKean County, Pennsylvania, representing only 5% of the total acreage in the county, were getting paid to not cut down their forests. Smaller landowners usually had to count trees manually, on foot in the woods, which made it too expensive for them to participate.

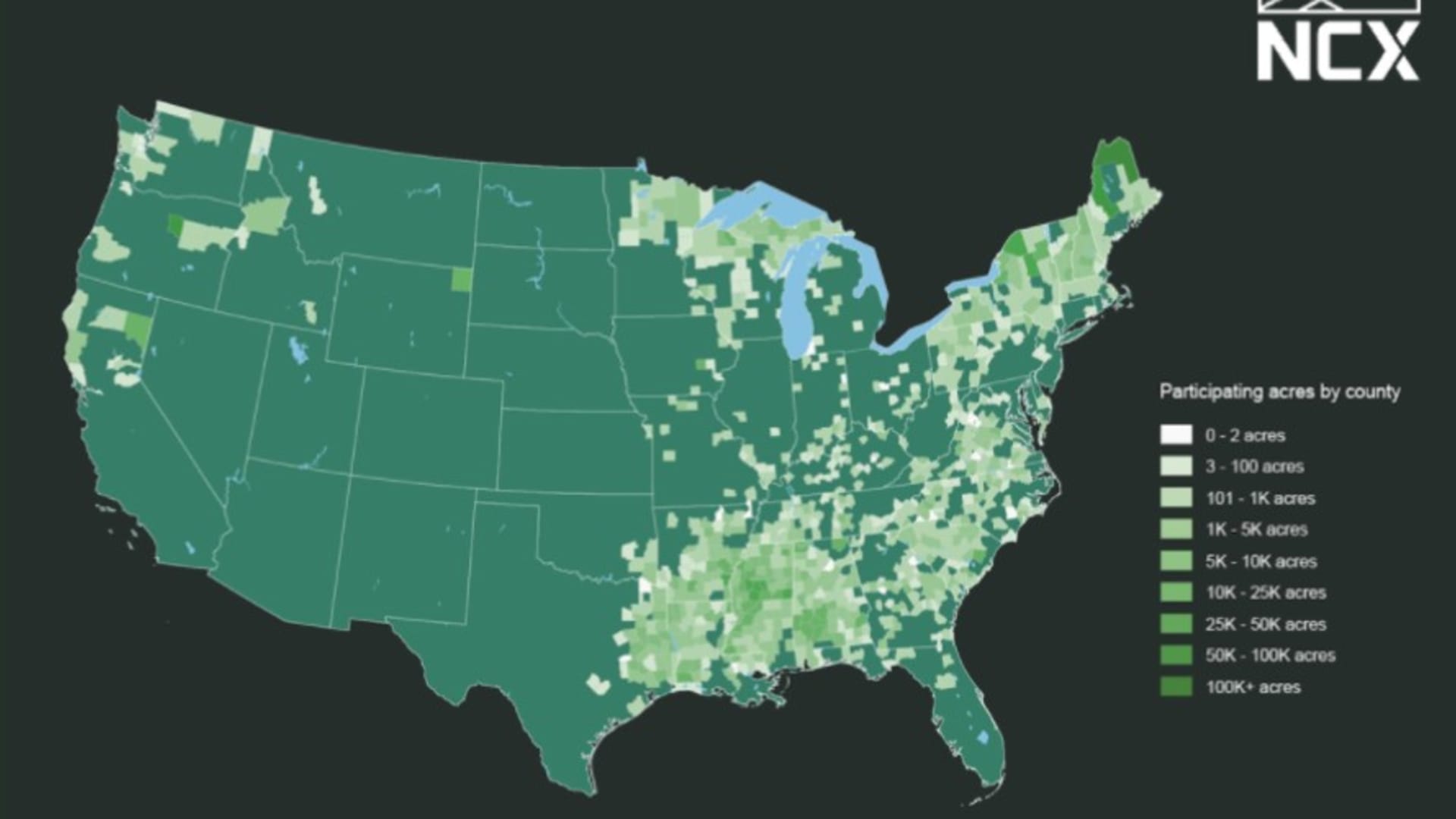

Since then, NCX has grown its business and currently serves 2,470 landowners with a collective 4.3 million acres across 39 states.

"Basically we show up to landowners and we say, 'Hey guys, heard you like cutting down trees for money?' And they say, 'Yep.' And we say, 'How about not cutting down trees for money and growing them for carbon instead?' And they say, 'How much money are you talking about?'"

The money can vary a lot, depending on the species, age and the number of trees on an enrolled property. As a general ballpark, however, if a landowner might make $10,000 for cutting down their trees for a timber harvest, they might get a payment of around $600 a year to keep their trees growing, NCX told CNBC. At that rate, it would take about 17 years of payments to break even.

On the other end of the transactions, NCX sells the resulting carbon offsets to Microsoft (which is also an investor), Rubicon, Incyte and Patch, to name a few. (Although Benioff's firm is an investor, Salesforce is not a customer.)

Customers contract to buy a carbon credit for a year, during which time the landowners defer harvesting the the timber on their land. The deal is based on trust, but taking satellite image measurements at the beginning of the year and at the end of the year gives landowners and buyers confidence. The company's measurement approach has attracted early interest from Verra, a nonprofit that measures and establishes standards for the voluntary carbon offset market, and the organization's certification could someday serve as further validation for its approach.

"We say all the time that measurements make markets," Nova told CNBC. "That's the foundation for making these markets work, and so we do that through this satellite measurement of every acre every year."