- Liberty Media Chairman John Malone said the market's fixation on growth and soaring equity valuations remind him of the dot-com bubble in the late 1990s.

- "There's no question that the equity markets right now are so interested in growth above all other criteria and this is, like, the bubble in the late '90s ... through 2000," Malone said. "This is a land rush right now. Profitability to be determined later."

Liberty Media Chairman John Malone said the sizzling IPO market and soaring equity valuations remind him of the dot-com bubble in the late 1990s.

"There's no question that the equity markets right now are so interested in growth above all other criteria and this is, like, the bubble in the late '90s ... through 2000," Malone said in a recorded interview with CNBC's David Faber that aired Thursday. "It's all about growth. This is a land rush right now. Profitability to be determined later."

It's been a blockbuster year for U.S. public market listings, which just surpassed an unprecedented $1 trillion marker, a record that more than doubles 2020 levels. Amid the IPO boom, many money-losing start-ups are able to score sky-high market capitalizations that some believe are detached from their fundamentals. The fixation on future growth and profitability sparked worries among investors and strategists on Wall Street about the level of froth in the market right now. The S&P 500 is up 25% this year.

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter here.

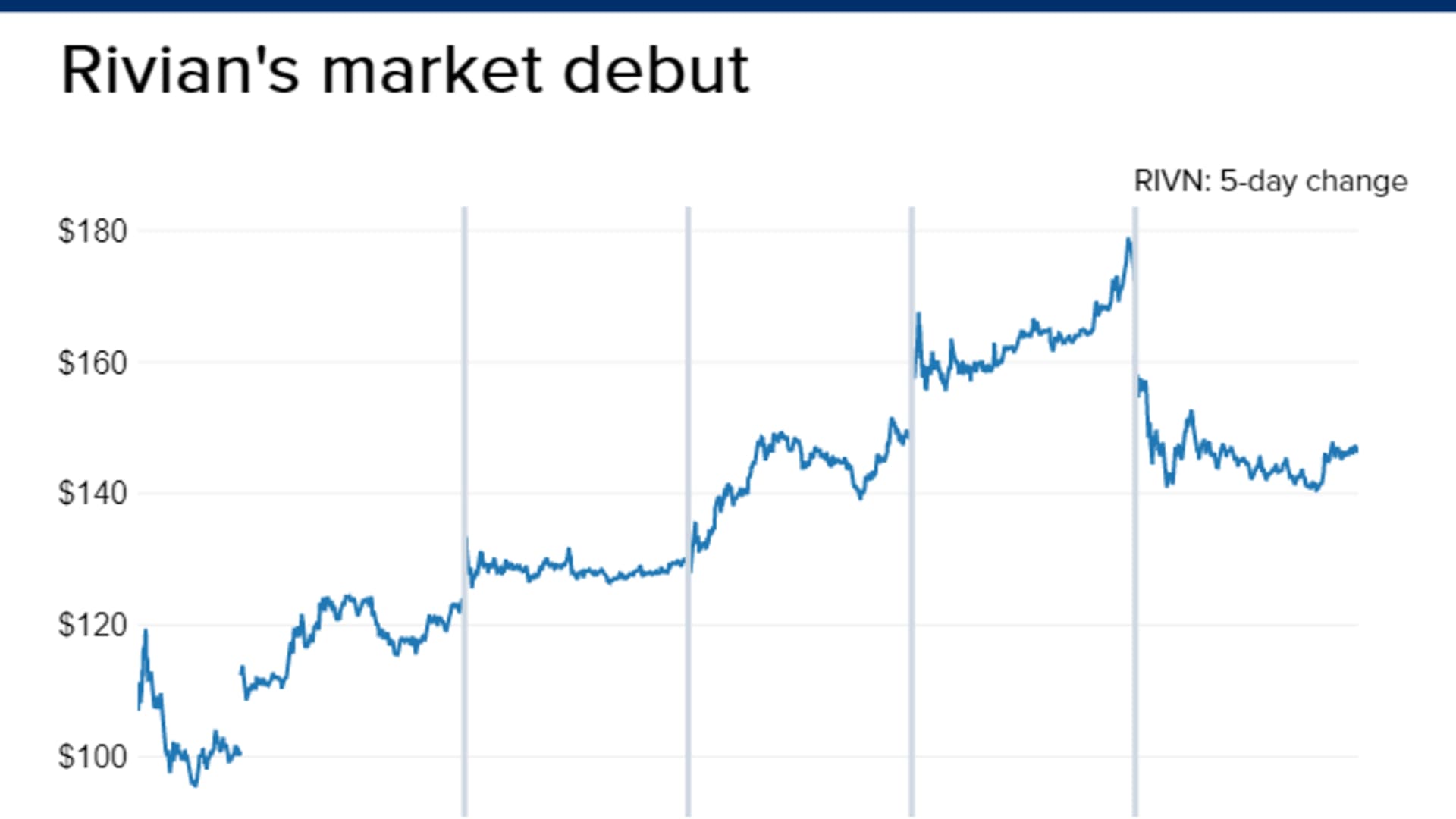

"If you have a lot of cheap money creating too much competition particularly in capital-intensive businesses, it can wreck the profitability of any business," Malone said. "There's a car company [Rivian] that I guess is just going public that has a $130 billion market cap."

Rivian notched the second-highest valuation for a listing this year after its offering increased its total by about $67 billion. Shares of the electric vehicle maker at one point doubled in value, trading around $150 billion at their high. Yet, the company is still losing money and barely generating revenue.

Rivian is producing and selling its first product, an electric pickup called the R1T. The company announced it started producing saleable vehicles at its Illinois factory in September, followed shortly after by shipments to employees and early customers who had reserved the truck.

The 80-year-old mogul said he's spent his career building businesses with long-term horizons and solid fundamentals.

Money Report

"I've always been a long-term investor and so I'm much more interested in building this business brick by brick, making it solid and sticky," Malone said. "'How can you grow it,' and, 'how can you grow pricing power,' and, 'how can you defend the franchises that you're building?'"

Malone built cable empire TCI in the 1970s before selling it to AT&T in 1999 for roughly $50 billion. Malone is now chairman and the largest voting shareholder of Liberty Media.