- The Federal Reserve's policy update Wednesday is the most important market event next week, CNBC's Jim Cramer said Friday.

- It's clear the Fed's emergency policy stance is "untenable" after Friday's consumer price index report, Cramer contended.

- "The only question is the pace of the rate hikes and the tone of the Fed's language," he said.

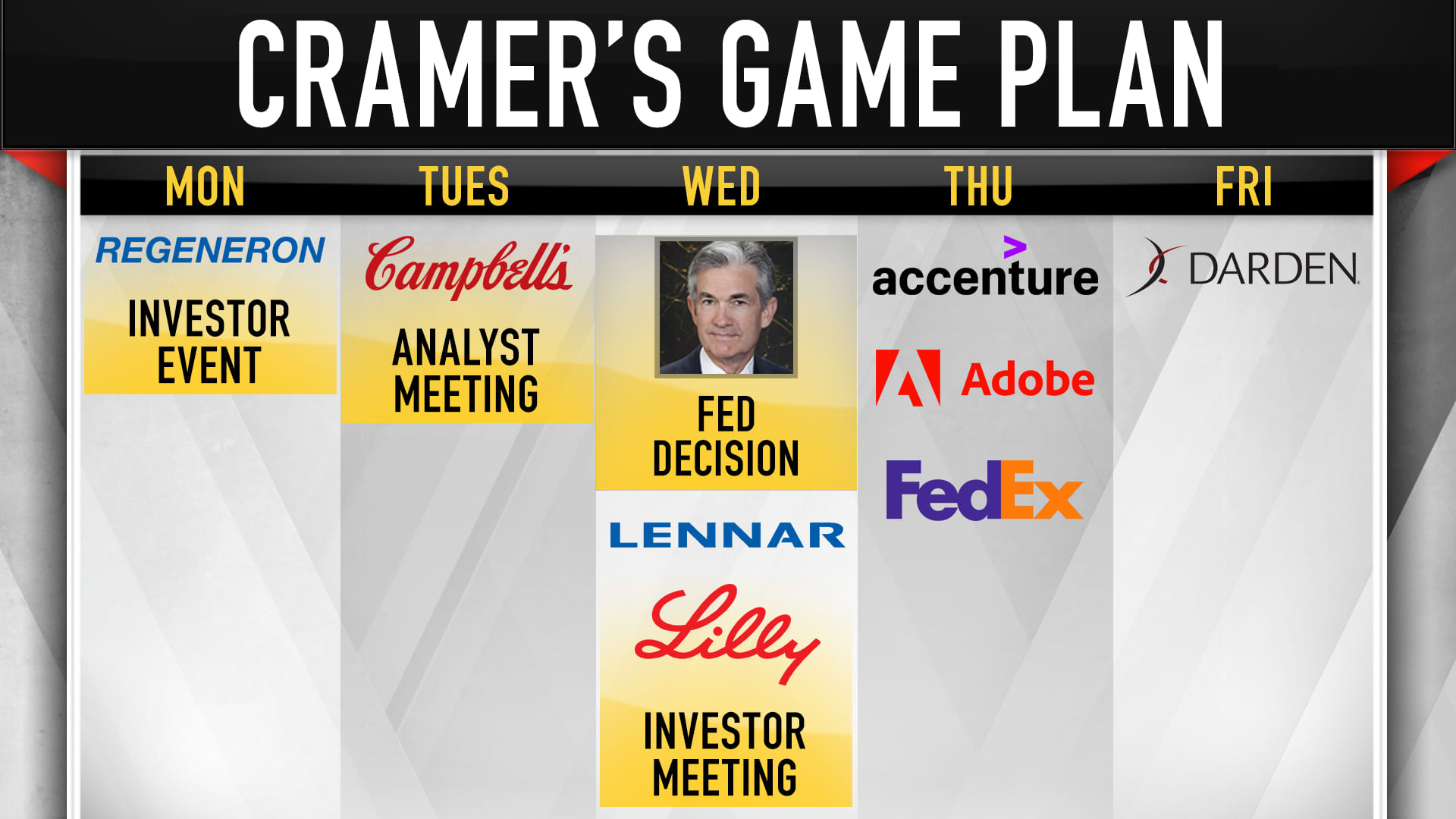

The most important event next week for Wall Street is scheduled for Wednesday afternoon, CNBC's Jim Cramer said Friday as he previewed the upcoming five trading days.

That's when all eyes will be on the Federal Reserve and its chairman, Jerome Powell, who will hold a press conference after the central bank's policymaking arm concludes its two-day meeting.

It's clear the Fed's emergency policy stance is "untenable" after Friday's consumer price index report, Cramer contended, and now "the only question is the pace of the rate hikes and the tone of the Fed's language."

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter here.

"If Powell says it's time for a series of lockstep rate hikes, then [Friday's] rally was definitely premature, and the stock market's going to get hammered," the "Mad Money" host said.

"But if he traces out the inflation and separates what can be controlled from what can't be controlled, then he may spare us from a term you're going to start hearing a lot starting next week" from bearish hedge fund managers who are short the market: a "crash landing," Cramer said.

Here's what else Cramer will be watching next week. All estimates are pulled from FactSet.

Monday: Regeneron investor day

- 4:30 p.m. investor event at the American Society of Hematology's annual meeting

Cramer said Regeneron typifies the kind of companies investors should own right now. It makes real products — in this case, therapeutics — and generates actual profits, he said, and its stock is reasonably valued. Put it together, and Cramer said he believes the stock should be able to perform well even as the Fed tightens policy.

Money Report

Tuesday: Campbell Soup investor day

- Investor day for fiscal 2020 at 9 a.m. ET

"While this stock is cheap, it's not cheap enough unless management can lay out a story of innovation, along with data showing that they can get away with raising prices. I'd love it if Campbell Soup could pull it off. I'm not holding my breath. Judging from the quarter, you may just have to listen to the event as an explainer, not a catalyst to buy. But I am always open-minded," he said.

Wednesday: Fed meeting, Lennar earnings and Eli Lilly analyst meeting

Fed meeting

- The Federal Open Market Committee's latest policy statement is set to be released at 2 p.m. ET

- Powell is slated to hold a press conference at 2:30 p.m. ET

Expect there to be major scrutiny of Powell's press conference, Cramer said. "Regardless of what he actually says, there will be people who come on air arguing that it's very, very bad for your portfolio. These people don't know history and tend not to know your stocks either. Don't take them too seriously."

- Q4 earnings after the bell; conference call at 11 a.m. ET Thursday

- Projected EPS: $4.15

- Projected revenue: $8.5 billion

- Investor meeting at 9 a.m. ET Wednesday

Cramer noted his charitable trust owns shares of Eli Lilly, emphasizing that he thinks the company's Alzheimer's drugs have terrific long-term prospects. "These could potentially be multi-billion dollar ... franchises," Cramer said. Their stock, he added, "is worth buying."

Thursday: Accenture, Adobe, Jabil and FedEx earnings

- Q1 earnings before the bell; conference call at 8 a.m. ET Thursday

- Projected EPS: $2.64

- Projected revenue: $14.21 billion

The professional services company typically trades erratically on earnings days before calming down by the end of the following session, Cramer said, advising that investors who want to start a position in Accenture wait a bit before doing so.

- Q4 earnings release before the open; conference call at 11 a.m. ET Thursday

- Projected EPS: $3.20

- Projected revenue: $4.1 billion

Although Cramer wants investors to limit their exposure to high-multiple tech stocks, he said Adobe is one of the few that remain worth owning because the software firm is so solid. Salesforce and Nvidia are other examples, he said.

- Q1 results before the bell; conference call at 8:30 a.m. ET Thursday

- Projected EPS: $1.80

- Projected revenue: $8.28 billion

- Q2 earnings after the close; conference call at 5:30 p.m. ET Thursday

- Projected EPS: $4.27

- Projected revenue: $22.41 billion

Cramer said predicting how FedEx will trade is very challenging, so he does not have the conviction necessary to recommend it to "Mad Money" viewers.

Friday: Darden Restaurants earnings

- Q2 results before the bell; conference call at 8:30 a.m. ET Friday

- Projected EPS: $1.43

- Projected sales: $2.23 billion

"Darden's got deep pockets. They can afford to win in this industry, so I'm looking for a very solid report," Cramer said.

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market. Disclosure: Cramer's charitable trust owns shares of Eli Lilly, Salesforce and Nvidia.

Disclaimer

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com