- The stock market's recent weakness may soon come to an end, according to veteran technical analyst Larry Williams.

- "The charts, as interpreted by Larry Williams, suggest that .... we've got a fabulous setup for a meaningful, possibly long-lasting rally that no one is looking for," CNBC's Jim Cramer said Wednesday.

CNBC's Jim Cramer on Wednesday broke down fresh technical analysis from veteran chartist Larry Williams, who concluded the stock market's recent weakness may soon come to an end.

"The charts, as interpreted by Larry Williams, suggest that .... we've got a fabulous setup for a meaningful, possibly long-lasting rally that no one is looking for," the "Mad Money" host said.

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter here.

"I wouldn't be at all surprised if this is an 'always darkest before the dawn' scenario," Cramer said, offering his interpretation of Williams' work. "That's why I keep telling you to have some cash on hand as we do for the CNBC Investing Club .... ready to pounce when our favorite stocks come down to the right levels, even as the dire nature of Russia and Ukraine and the rampant inflation out there make you feel like it's impossible to have a sustained rally."

However, Williams believes the stock market may bottom within the next five trading days, Cramer explained. Among the reasons for Williams' call is the latest data from the Commodity Futures Trading Commission, specifically the net holdings of small and large speculators — as well as commercial hedgers — for S&P futures contracts.

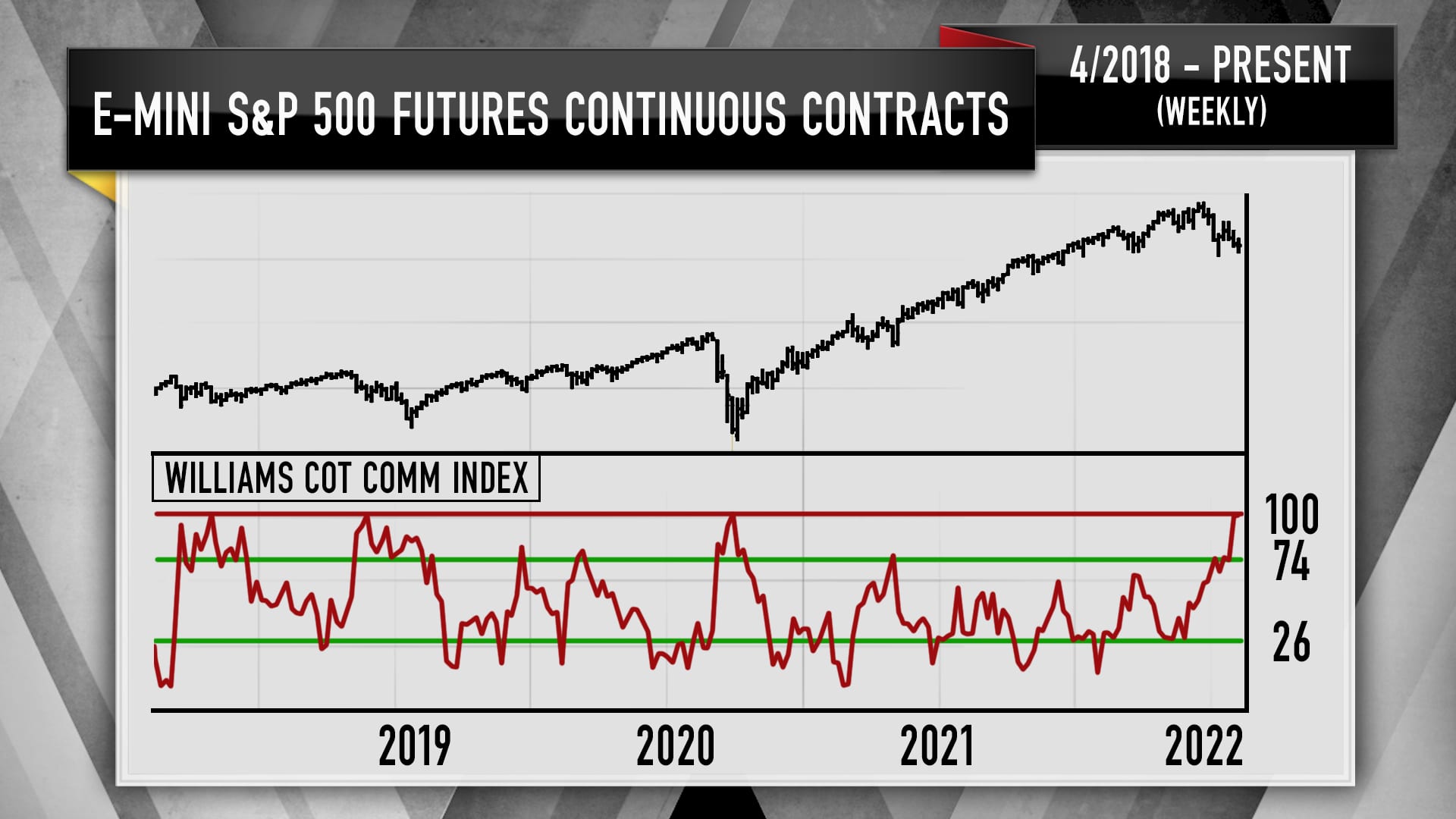

Here's a chart showing the position of commercial hedgers for S&P futures — which in this case tend to be banks, mutual funds and possibly even governments — from 2018 to present.

"Williams points out that his commercial commitments of traders index ... went to its highest reading in the last five years. That tells him a lot of sophisticated money has entered the market on the long side, and historically that means a rally is coming," Cramer explained.

Money Report

The last time a reading was this high came in late March 2020, around the time the U.S. stock market reached its lows of the Covid pandemic, Cramer said, noting that ultimately proved to be a good time to buy stocks.

"Once again, the commercial hedgers are telling Larry that it's time to hold your nose [and] buy something because he expects the S&P to bottom by next Tuesday," Cramer said.

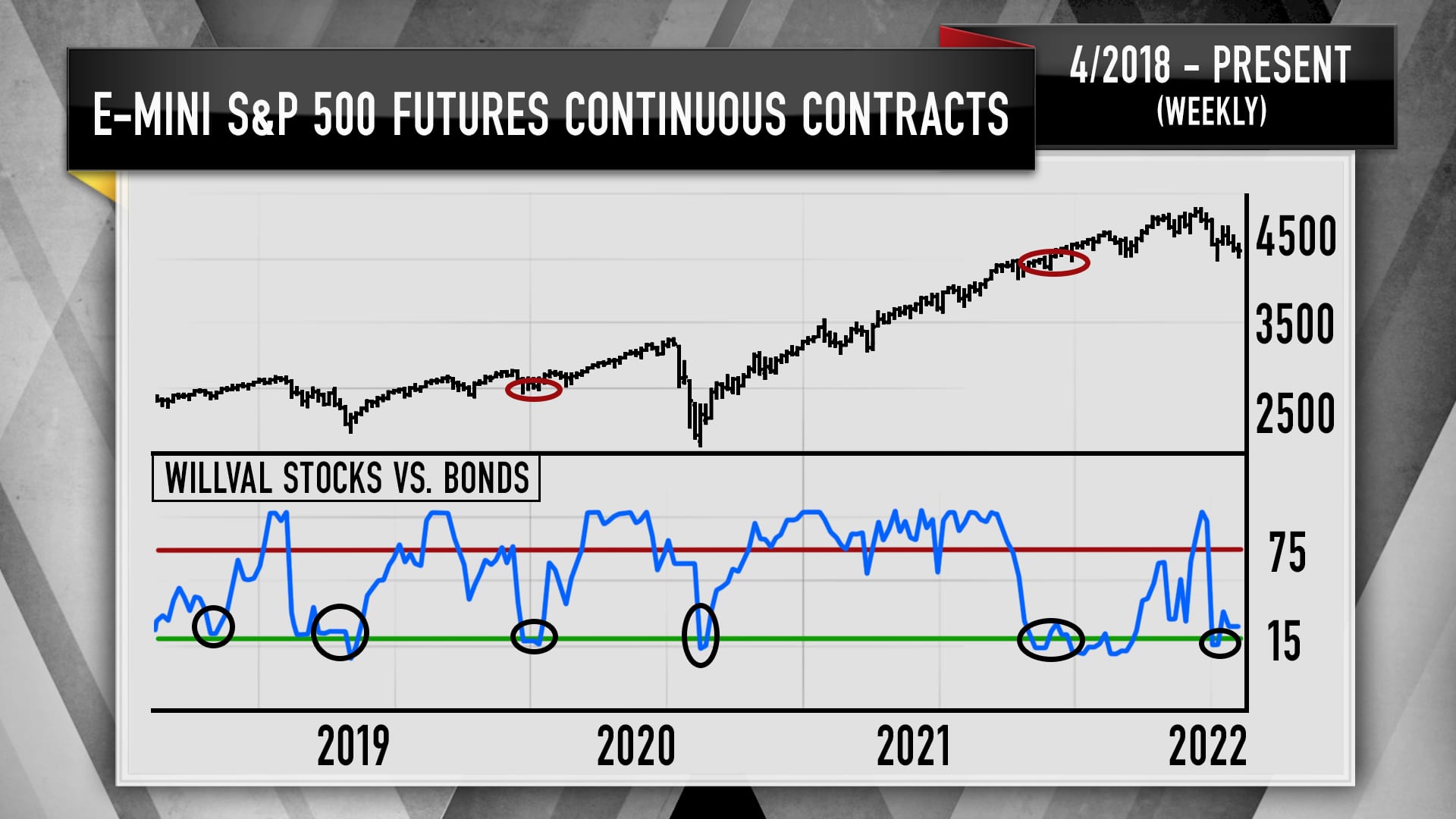

Cramer said another reason for Williams' forecast stems from his proprietary indicator known as the WillVal. In this case, it's measuring the valuation of stocks versus bonds. Historically, Cramer said that buying the S&P 500 when it's cheap relative to bonds has worked out well.

Here's a chart showing S&P futures versus the bond market from 2018 through present.

"Sure enough, right now, at this very moment, the stock market's incredibly undervalued compared to bonds, which is yet another sign to Williams that this is a buying opportunity," Cramer said.

After looking at a few other parts of the technical picture, Williams still believes the market will soon get past its Ukraine-related weakness, Cramer said. "However, while he's predicting a pretty good rally, he also acknowledges it's going to be a choppy affair, not a direct staircase to heaven," he added.

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market.

Disclaimer

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com