- Living in New Jersey comes with access to New York City, Philadelphia and the Jersey Shore.

- The price for that is high taxes for both individuals and businesses.

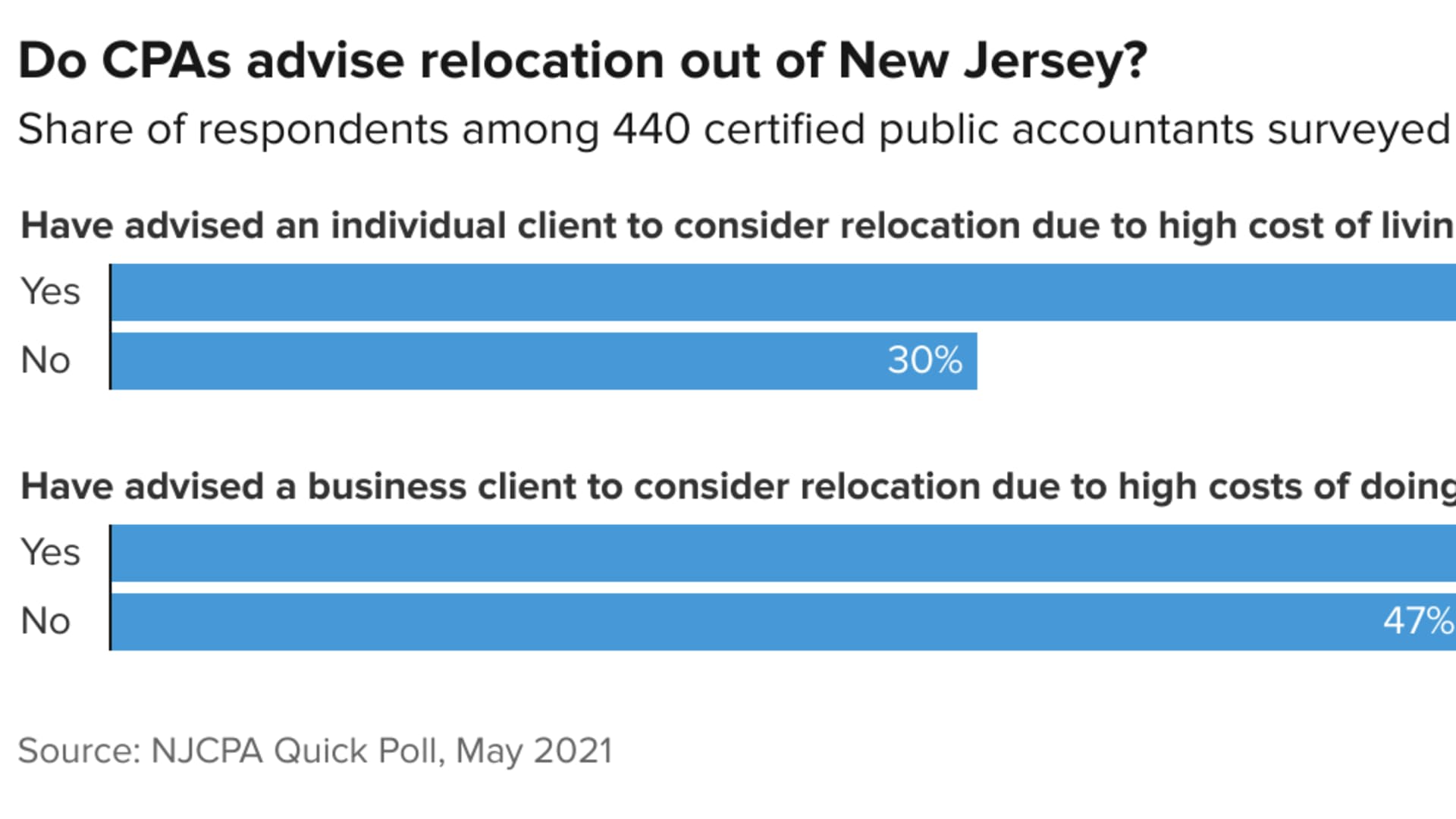

- A new survey shows that more than 50% of certified public accountants have recommended those clients leave in order to escape the high cost of living.

Certified public accountants have a message for New Jersey-based clients: It's time to move to a lower-cost state.

That's according to a recent survey from the New Jersey Society of CPAs, which found that 70% of professionals surveyed who have clients in the state have advised them to move due to the high cost of living.

Meanwhile, 53% of accountants surveyed said they have told business clients in the Garden State to relocate due to the high cost of doing business.

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter here.

More from Personal Finance:

How to tap your home for cash as home values rise

Why inflation is both good and bad for your wallet

Here's how to snag the best Amazon Prime Day deals

The reason CPAs prod their clients to move comes down to their fiduciary obligation to give good advice, said Ralph Thomas, CEO and executive director at NJCPA.

There's another reason they're having those conversations: taxes.

"The tax structure here is one of the highest in the country, if not the highest, and that certainly is a negative issue for individuals and for businesses," Thomas said.

High property taxes and corporate tax rates were cited as top concerns among the CPAs surveyed.

Money Report

For businesses, top concerns cited include lack of skilled personnel, regulatory requirements and domestic economic conditions.

NJCPA provides data and information to encourage the state to streamline its government.

The organization has done work to address the gas and estate taxes. Among the current priorities on its agenda is the inheritance tax, Thomas said, which could be streamlined to be more equitable.

The survey found that CPAs are seeing more high-income clients leave the state. About 60% said they have seen more high-income clients file as New Jersey non-residents. At the same time, about 70% of CPAs said they saw a decrease in the number of high-income clients who have state residency.

Popular locations for relocation include states where the cost of living and taxes are cheaper, Thomas said, such as Delaware, Pennsylvania, Florida, North Carolina, South Carolina, Tennessee and Texas.

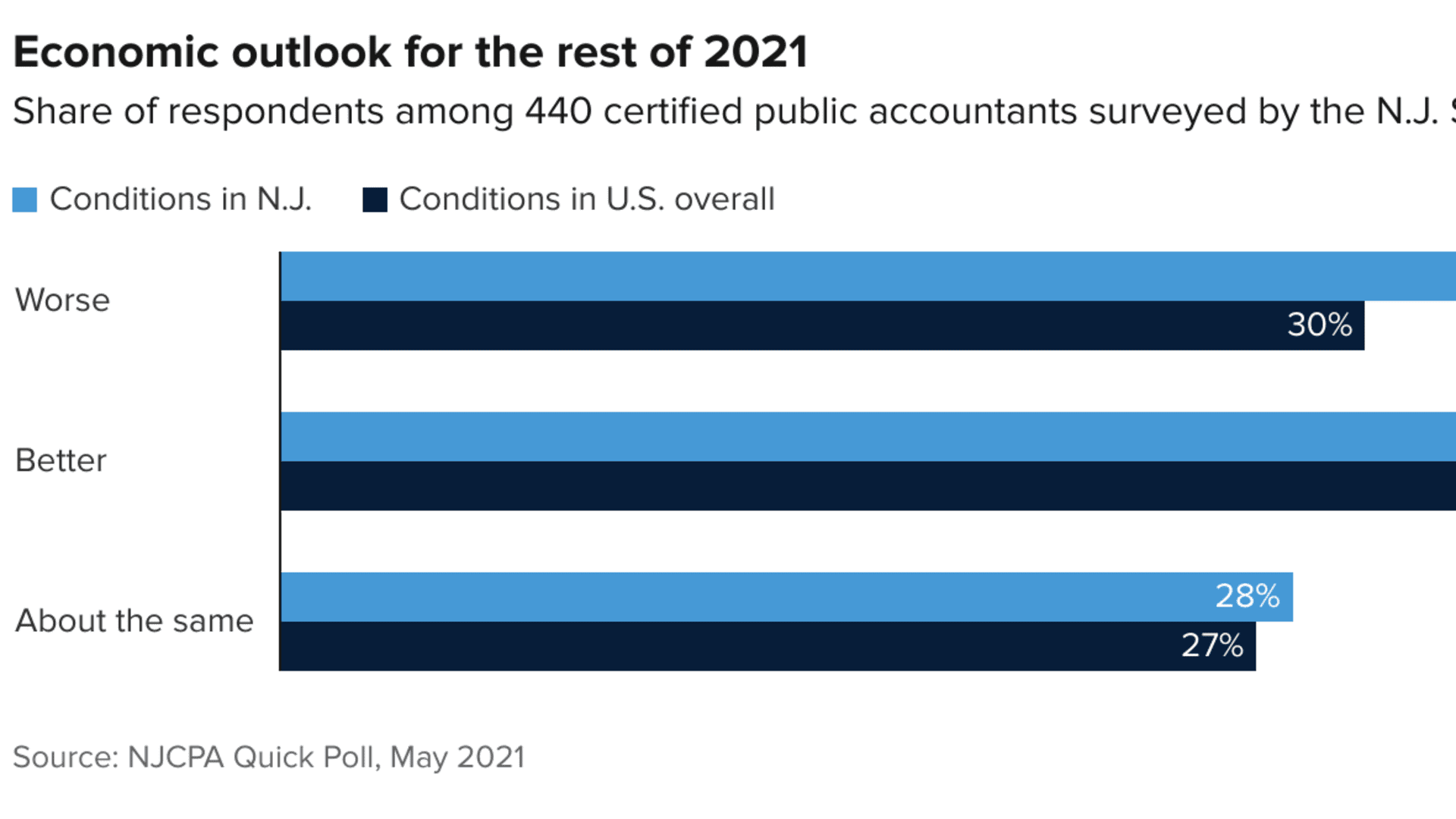

The accountants were more pessimistic about the economic outlook for New Jersey for the rest of 2021 compared to the overall U.S.

The survey found that 37% said New Jersey will fare worse in the rest of the year, versus 30% who said the same for the U.S. Meanwhile, 35% said New Jersey's economic conditions will be better in the rest of 2021, versus 43% who said the same for the U.S.

NJCPA's survey, which was sponsored by Provident Bank, was conducted in May and included 440 certified public accountants.