- AMC Entertainment on Thursday filed to sell 11.5 million shares of its stock.

- Shares of AMC turned negative in premarket trading on the news, giving up a big gain.

- AMC said it plans to use the money from the stock sale for "general corporate purposes," which may include paying down existing debt and acquiring theater assets.

- "We believe that the recent volatility and our current market prices reflect market and trading dynamics unrelated to our underlying business, or macro or industry fundamentals, and we do not know how long these dynamics will last," AMC said in the SEC filing.

AMC Entertainment said Thursday it plans to sell more than 11 million shares amid the trading frenzy in its stock.

"In accordance with the terms of the Distribution Agreement, we may, through our sales agents, offer and sell from time to time up to an aggregate of 11,550,000 shares of our Class A common stock," AMC said in an SEC filing.

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter here.

Shares of AMC dropped 4% on Thursday and was briefly halted for volatility. AMC shares were up more than 20% in premarket trading before news of the stock sale.

AMC later said it completed its new stock offering announced just this morning, raising $587.4 million in additional capital.

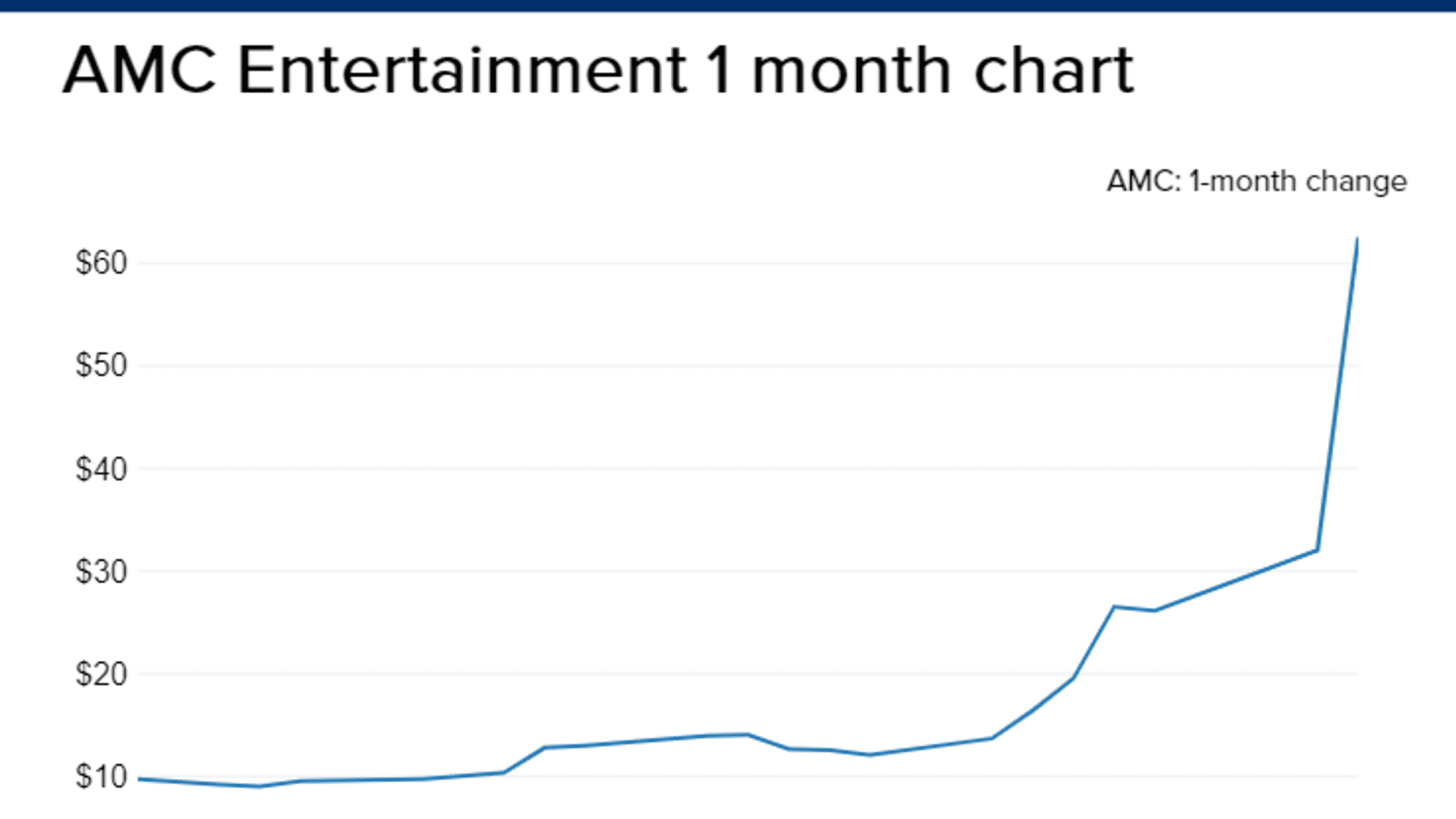

AMC Entertainment is garnering attention from WallStreetBets traders in recent weeks, pushing the stock up nearly 140% this week to an all-time high of $62.55 on Wednesday. AMC is up 512% this quarter and a whopping 2,850% this year. The market value has ballooned to above $31 billion.

Money Report

"We believe that the recent volatility and our current market prices reflect market and trading dynamics unrelated to our underlying business, or macro or industry fundamentals, and we do not know how long these dynamics will last," the company said in the filing. "Under the circumstances, we caution you against investing in our Class A common stock, unless you are prepared to incur the risk of losing all or a substantial portion of your investment."

In a parallel to the epic short squeeze of GameStop in January, short-sellers have increased their bets against AMC shares over the last month, possibly fueling the move higher. About 18% of the AMC shares available for trading were still sold short through Wednesday, according to S3 Partners.

AMC has embraced its new status as a meme stock. On Wednesday, the company launched AMC Investor Connect for its retail investors, providing them with exclusive promotions like a free tub of popcorn and direct communications with CEO Adam Aron, who has been dubbed "Silverback."

The encouragement of retail traders comes as the company moves to sell millions of shares into the market to raise capital. In typical times, a share sale from a company hurts the stock price in the short term as it dilutes the number of share outstanding.

AMC said it plans to use the money from the stock sale for "general corporate purposes," which may include paying down existing debt and acquisition of theater assets.

B. Riley Securities and Citigroup Global Markets are AMC's sale agents for the stock sale.

Separately, AMC on Tuesday announced a sale of 8.5 million shares to Mudrick Capital at approximately $27.12 per share — worth about $230.5 million. Despite that share sale, the stock continued to go higher as retail investors cheered the capital raise.

Enjoyed this article?

For exclusive stock picks, investment ideas and CNBC global livestream

Sign up for CNBC Pro

Start your free trial now