- Vesting schedules — the length of time you must be at an employer for its 401(k) contributions to be 100% yours — can be as much as six years.

- The most common matching formula is 50 cents for each dollar contributed by the employee, up to 6% of pay.

- Vesting can happen gradually over time or all at once.

If your employer's contributions to your 401(k) plan are a big part of your retirement planning, be sure you understand when that money will actually belong to you.

Vesting schedules — the length of time you must be at an employer for its contributions to be 100% yours — can be up to six years.

Nevertheless, company 401(k) plan matches are identified as important to reaching retirement goals by 62% of workers, according to research from Principal Financial Group.

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter here.

"Given most employers view 401(k) matches as part of total compensation, it is important that employees don't leave this money on the table without at least contributing enough to get the match," said Sri Reddy, senior vice president of retirement and income solutions at Principal Financial Group.

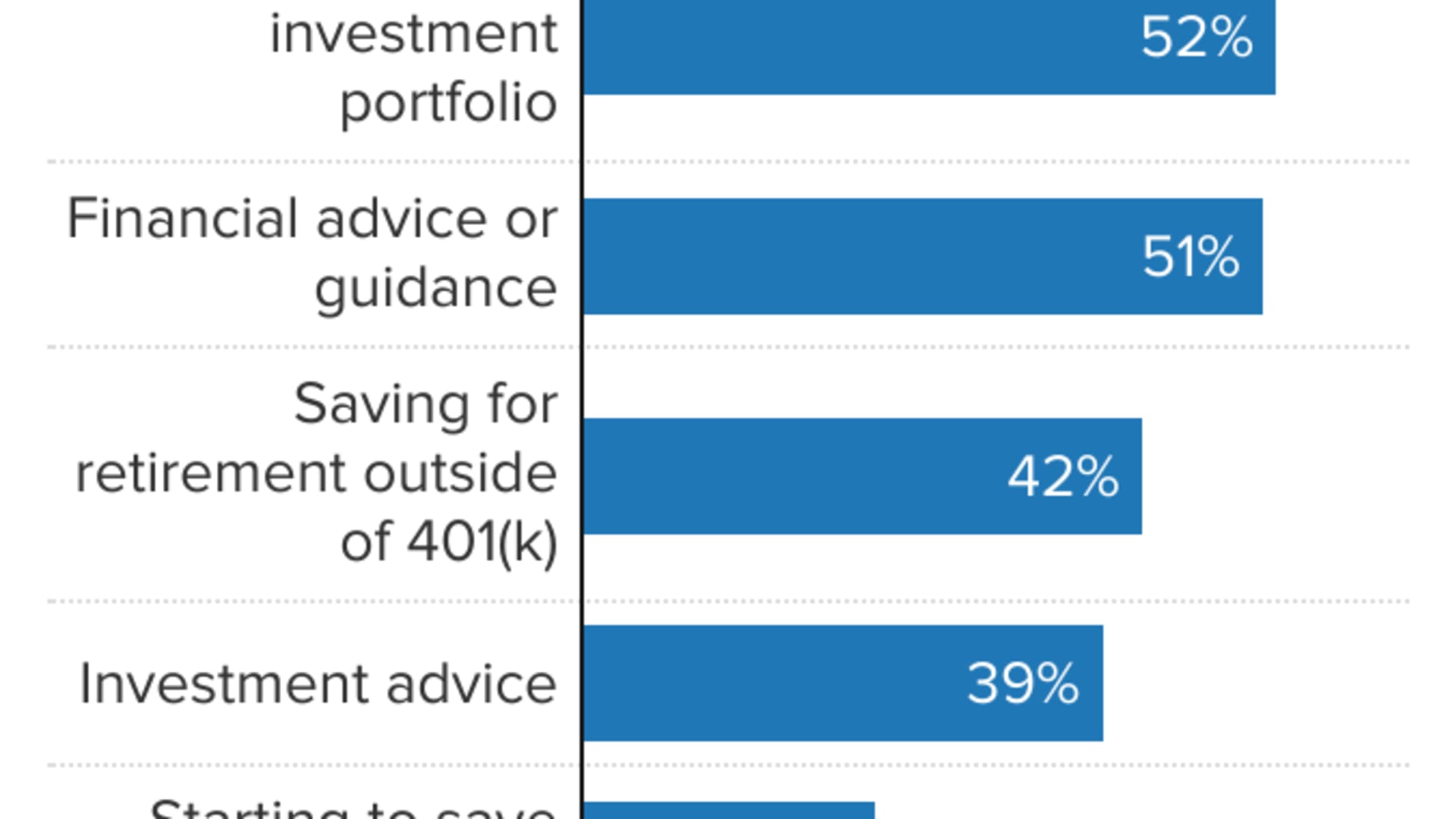

Having a balanced investment portfolio ranked second (52%) in importance for reaching retirement goals in the Principal survey, and getting financial advice or guidance was third (51%).

Money Report

Most 401(k) plans — 98% — make contributions to workers' retirement savings, according to the Plan Sponsor Council of America. Some employers give nonmatching contributions — a portion of company profits regardless of how much the employee is saving — while others match a percentage of a worker's savings.

The most common matching formula is 50 cents for each dollar contributed by the employee, up to 6% of pay, the council's research shows.

Vesting either happens gradually — e.g., 20% of the match is credited after one year, 40% after two years, and so on — or occurs all at once after the vesting period. Of course, any contributions you make to your account are always 100% yours.

About 41% of employers that match employee contributions provide immediate vesting, according to the council. About 16% make workers wait six years before the matches are entirely theirs.

Regardless of the time it takes for matches to fully vest, financial advisors generally recommend contributing at least enough to get the company match.

If you have a traditional 401(k) plan, your contributions are made pretax, which reduces your taxable income and, in turn, how much you pay in taxes, although your withdrawals in retirement will be taxed. If it's a Roth 401(k), your contributions are made after-tax, but distributions later in life are generally tax-free.

And, whether you contribute to a traditional or Roth 401(k), the company's match always goes into the former and is not taxable compensation. Also, employer contributions do not count toward the contribution maximums.

The contribution limit for 2022 is $20,500. Workers age 50 and older are allowed an extra $6,500 as a "catch-up" contribution, for a total of $27,000.