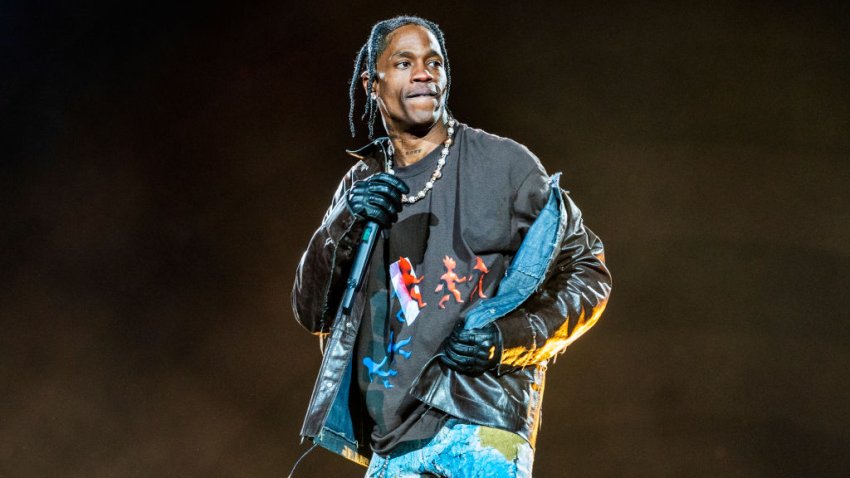

Billie Eilish, Green Day and other artists back bill that would reform live-event ticketing system

Over 250 artists signed a letter Thursday issuing their support for the Fans First Act.

-

Haiti's Prime Minister resigns amid growing violence in the country

Ariel Henry resigned Thursday as prime minister of Haiti, leaving the way clear for a new government to be formed in the Caribbean country, which has been wracked by gang violence.

-

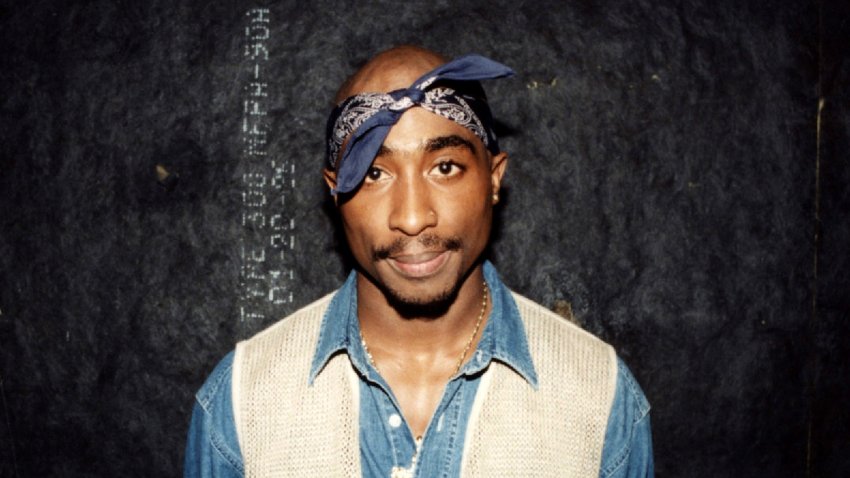

Tupac's estate threatens to sue Drake over diss track using what appears to be late rapper's AI-generated voice

A lawyer for Tupac Shakur’s estate said “the estate would never have given its approval for this use.”

-

Harvey Weinstein's 2020 rape conviction overturned by NY appeals court

New York’s highest court has overturned Harvey Weinstein’s 2020 rape conviction and ordered a new trial. The Court of Appeals ruled Thursday that the judge at the disgraced movie mogul’s landmark #MeT... -

Supreme Court seems skeptical of Trump's immunity claim in election interference case

The Supreme Court will hear oral arguments today over whether Donald Trump is immune from prosecution in a case charging him with plotting to overturn the results of the 2020 presidential election....