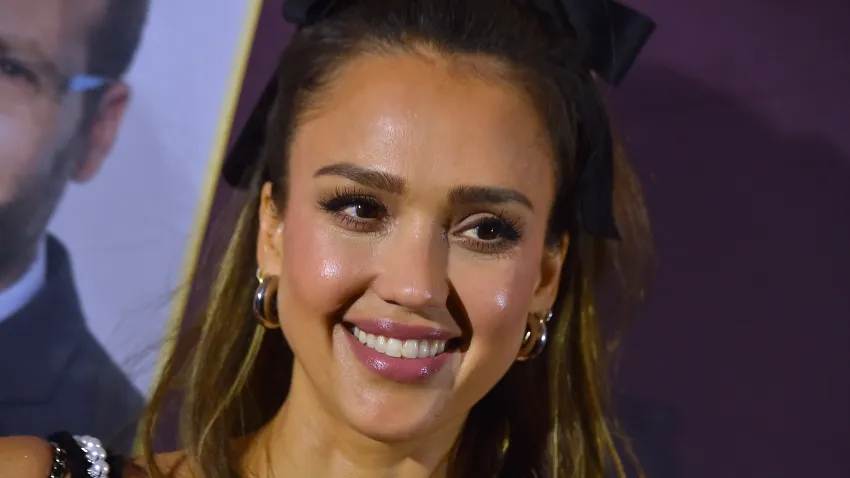

Jessica Alba steps down as chief creative officer at Honest, the personal care company she founded

-

Kia recalls over 427,000 Telluride SUVs because they might roll away while parked

Kia is recalling more than 427,000 of its Telluride SUVs due to a defect that may cause the cars to roll away while they’re parked.

-

New $20 minimum wage for fast food workers in California set to start Monday

Most of California’s fast food workers are set to be paid at least $20 per hour. A new law mandating the minimum wage increase for fast food workers is scheduled to take effect on Monday.... -

‘Guilt tipping' is getting out of control, but signs show consumers are pushing back

Recent reports show shoppers are experiencing “tip fatigue” and starting to tip less — and resent “guilt tipping” even more.

-

Linda Bean, entrepreneur, GOP activist and granddaughter of LL Bean, has died

Linda L. Bean, a granddaughter of famed outdoor retailer L.L. Bean who became an entrepreneur, philanthropist and conservative activist, has died at age 82.