Lululemon to shutter Washington distribution center, lay off 128 employees after tripling warehouse footprint

Lululemon is shutting down its Washington distribution center and laying off 128 employees after it opened a massive new warehouse outside of Los Angeles.

-

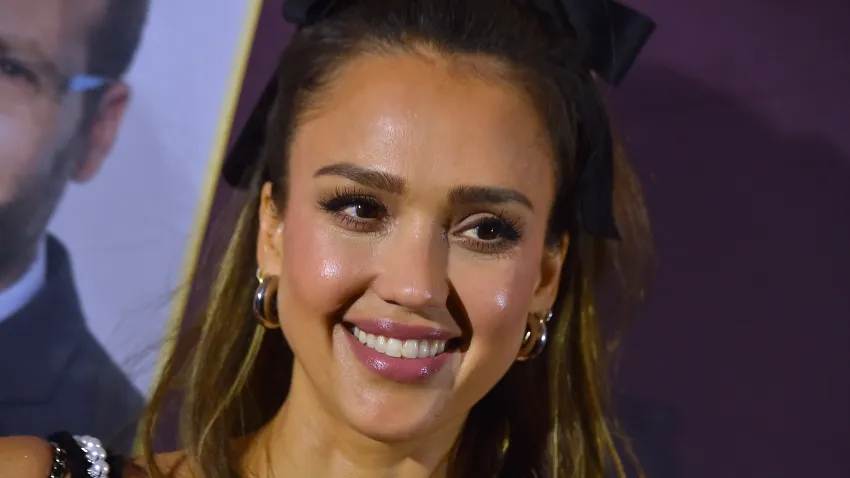

Jessica Alba steps down as chief creative officer at Honest, the personal care company she founded

Jessica Alba, who shot to fame in the James Cameron television series “Dark Angel,” as well as films such as “Sin City” and the “Fantastic Four,” will step down as chief creative officer at Honest Com... -

Tesla settles lawsuit over Apple engineer's death in a crash involving its Autopilot software

Tesla has settled a lawsuit brought by the family of a Silicon Valley engineer who died in a crash while relying on the company’s semi-autonomous driving software.

-

Yellen calls for level playing field for US workers and firms during China visit

The U.S. treasury secretary has called for a level playing field for American companies and workers as she opens a five-day visit to China in a major industrial and export hub. She told the governor o... -

Kia recalls over 427,000 Telluride SUVs because they might roll away while parked

Kia is recalling more than 427,000 of its Telluride SUVs due to a defect that may cause the cars to roll away while they’re parked.